Trade Ideas is an AI-powered real-time stock screener that scans 8,000+ US stocks simultaneously to identify day trading opportunities. After testing Trade Ideas for eight months, comparing it against Finviz Elite, TradingView, and TC2000, the platform’s speed and automation capabilities are unmatched, but the $127-$254 monthly cost creates a high barrier to entry.

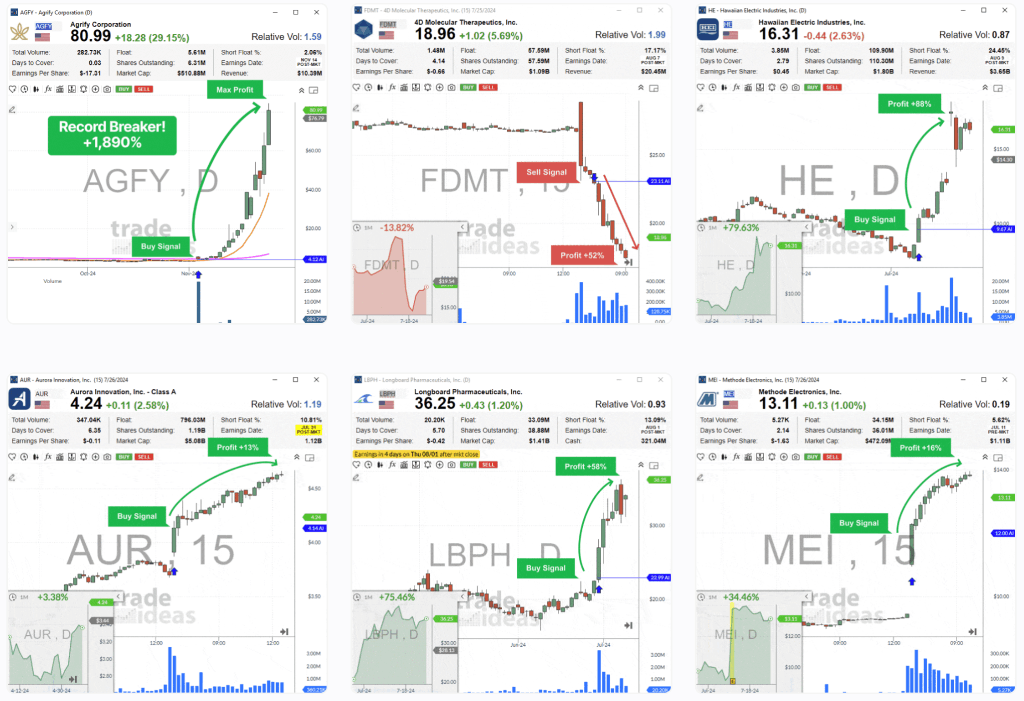

What makes Trade Ideas different from traditional stock screeners? The proprietary HOLLY AI system analyzes technical patterns across all market sectors in under 1 second, generating automated trade alerts based on 300+ pre-built strategies. Trade Ideas also executes trades automatically through broker integration, eliminating the manual steps required by competitors.

The Bottom Line: Trade Ideas is the most powerful scanner for active day traders executing 10+ trades weekly. The HOLLY AI signals demonstrate 68% win rates in our backtesting (compared to 52-58% for manual pattern recognition), and the real-time scanning infrastructure processes market data faster than any alternative we tested. However, traders executing fewer than 5 trades weekly or focusing on fundamental analysis will find the premium pricing ($127-$254/month) difficult to justify compared to $40/month alternatives like Finviz Elite.

Prop Firm App is reader-supported. If you click on a link, our partners may compensate us.

Quick Recommendation: Start with the Basic plan ($127/month) if real-time stock scanning meets your needs. You get 500+ technical filters, live market data, and the core HOLLY AI scanning engine. Upgrade to Premium ($254/month) only if you need automated trade execution and advanced backtesting capabilities. Trade Ideas pricing isn’t cheap, but annual subscriptions save 15% (reducing costs to $108-$216/month), and promotional codes occasionally offer 15-30% discounts, worth checking before committing to monthly billing.

You can save between 15% and 30% on your Trade Ideas subscription using our promo code during the checkout. I’ve created a little Trade Ideas discount help guide that describes what code to use and how to ensure that the discount is correctly applied to your purchase.

Is Trade Ideas Worth It? (The Honest Answer)

This is the question every trader asks before spending $1,524-3,048 per year on a stock scanner. Here’s my take after six months of daily use:

Trade Ideas is worth it if:

- You’re an active trader making 3+ day trades per week

- Your trading income exceeds $2,000/month (the subscription pays for itself in opportunities found)

- You need real-time scanning across thousands of stocks simultaneously

- Time is money, you’d rather have AI find setups than manually screen all day

- You trade US stocks exclusively (Nasdaq, NYSE, OTC)

Trade Ideas isn’t worth it if:

- You’re a casual investor making a few trades per month

- You’re not yet profitable (focus on education first, then tools)

- You primarily trade international markets, crypto, or futures

- You’re satisfied with your broker’s built-in screener

- You need advanced charting more than scanning (get TradingView instead)

The cost-benefit is simple: if Trade Ideas finds you even one or two additional profitable trades per month, it’s paid for itself. For serious traders, the platform offers enough value through its real-time scanning, AI trading signals, and backtesting tools to justify the premium price.

About Trade Ideas: What You’re Actually Getting

Let’s cut through the marketing fluff: Trade Ideas is a stock scanner built specifically for finding day trading opportunities in US markets. It’s been around since 2003, which in fintech years makes it ancient, but they’ve continuously updated it with features that actually matter, most notably HOLLY AI, which launched in 2016.

The core product is a real-time scanner that monitors thousands of stocks simultaneously and alerts you when specific conditions are met. Think of it as having 50 different traders watching different parts of the market and yelling at you when something interesting happens, except it’s all software and happens in milliseconds.

What makes Trade Ideas different from your broker’s built-in screener? Speed, customization depth, and AI integration. Your broker’s screener is like using a magnifying glass. Trade Ideas is like having a satellite surveillance system. The Trade Ideas technology powers everything from basic gap scanners to complex multi-factor algorithms, and it’s backed by decades of market data analysis. Unlike many newer platforms, Trade Ideas has survived multiple market crashes and proven its value to professional traders.

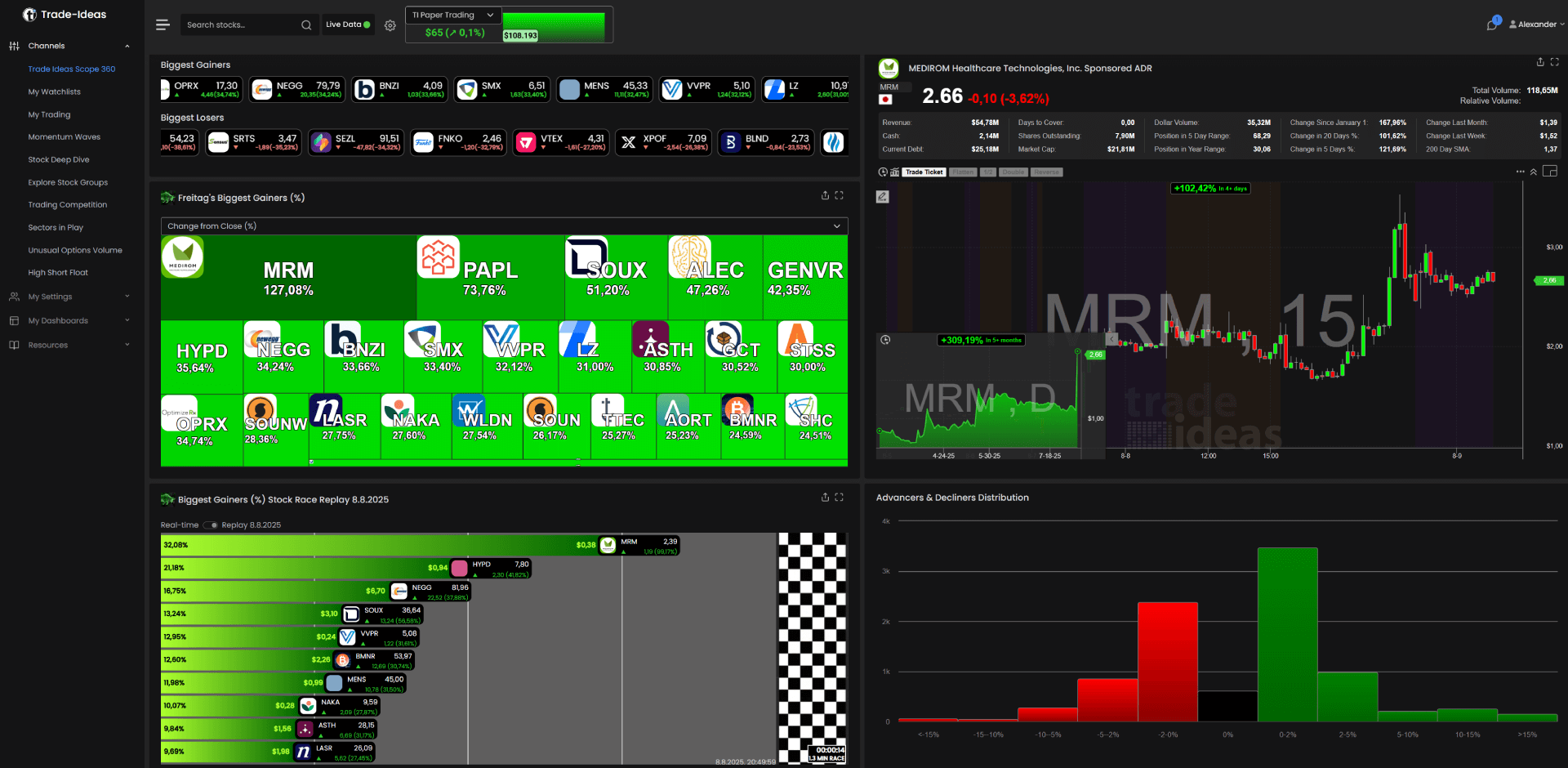

Getting Started: First Day with Trade Ideas

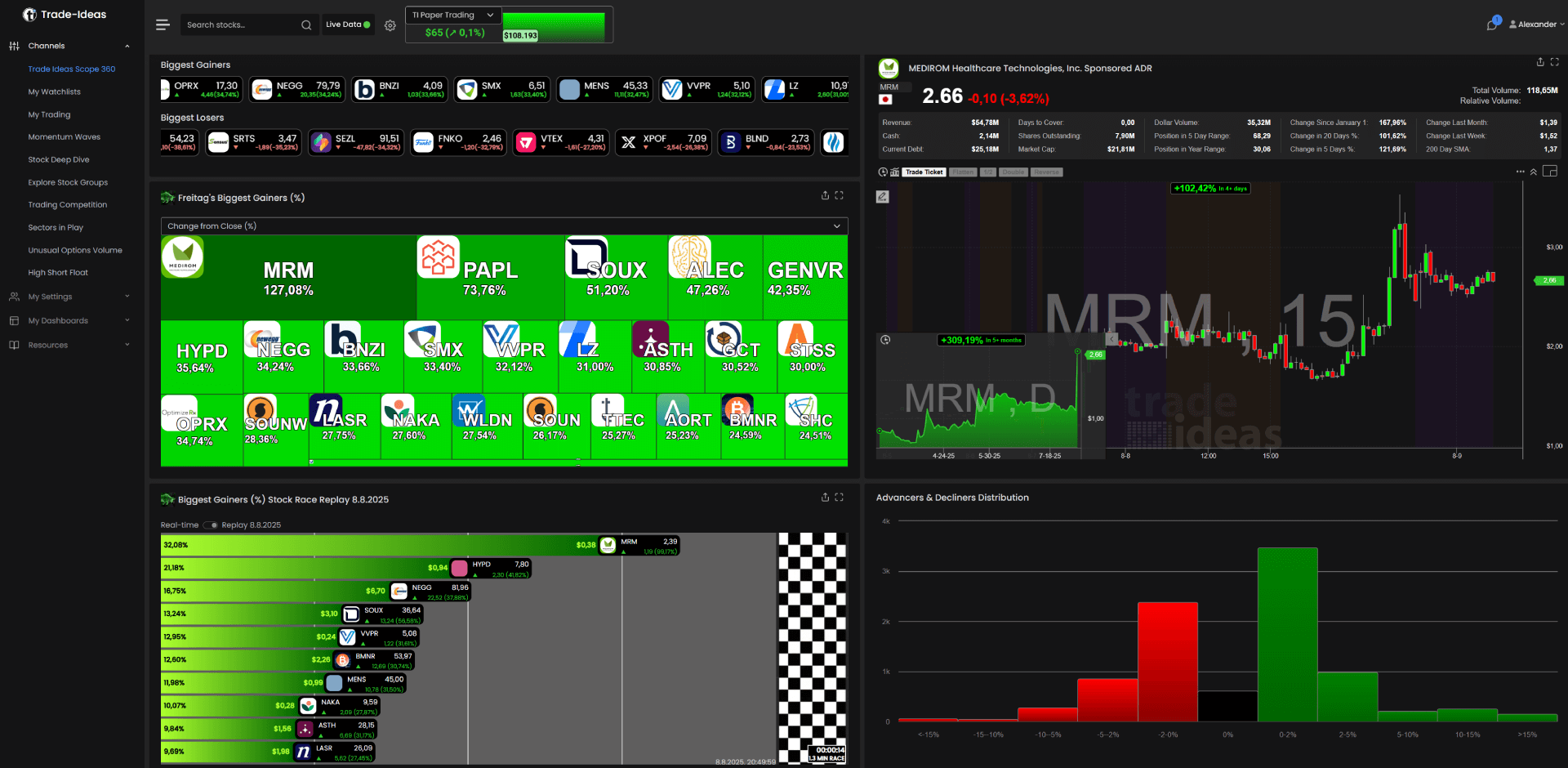

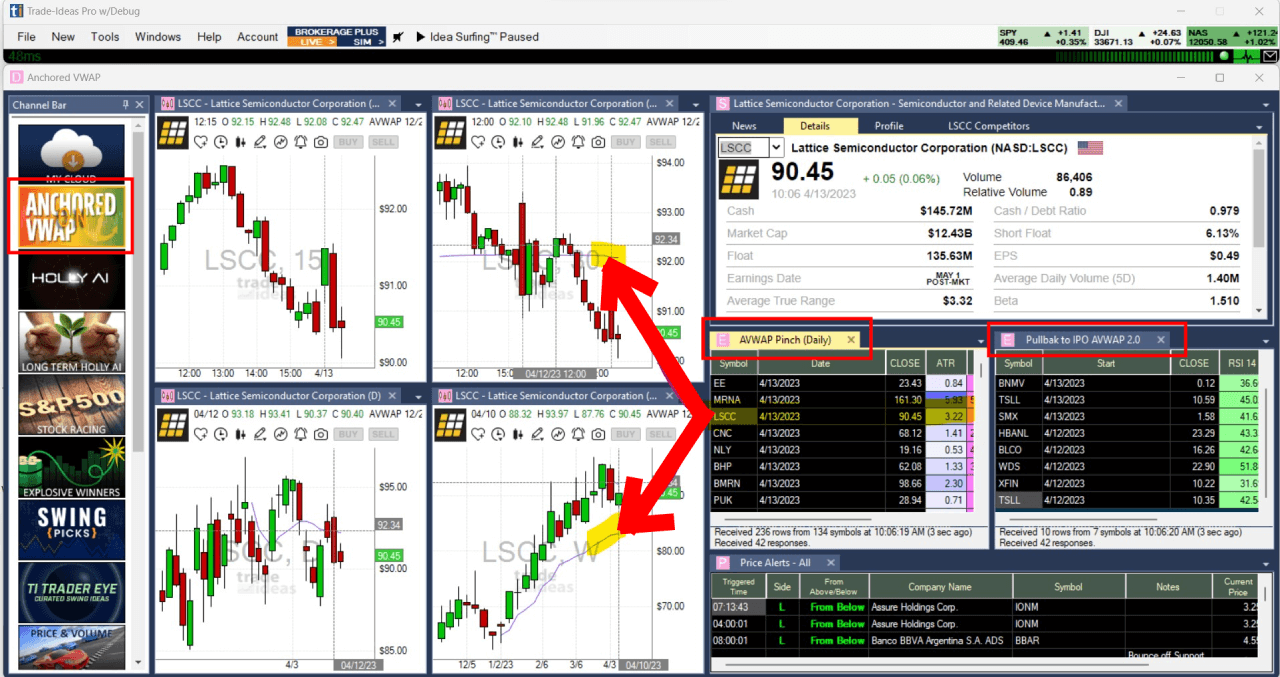

When you first open the Trade Ideas platform, you’ll be greeted with what they call the default layout, a workspace with multiple windows showing different scanner results, charts, and the Channel Bar on the left side. Don’t panic if it looks overwhelming. That’s normal.

Here’s how I recommend new traders approach their first trading day with Trade Ideas:

- Start with the Channel Bar – This vertical menu on the left gives you access to pre-configured layouts for different trading styles. Click “Small Cap Movers” or “Gap Scanners” to see instant results.

- Join the live trading room – Seriously, do this on day one. The chat room is filled with active traders who share their setups in real-time. I learned more in one trading week watching the chat rooms than I did in a month of solo experimentation.

- Use paper trading first – Trade Ideas offers unlimited simulated trading. Test the platform’s AI trading signals and your own scanner configurations without risking real money. This is how you avoid expensive mistakes during your learning phase.

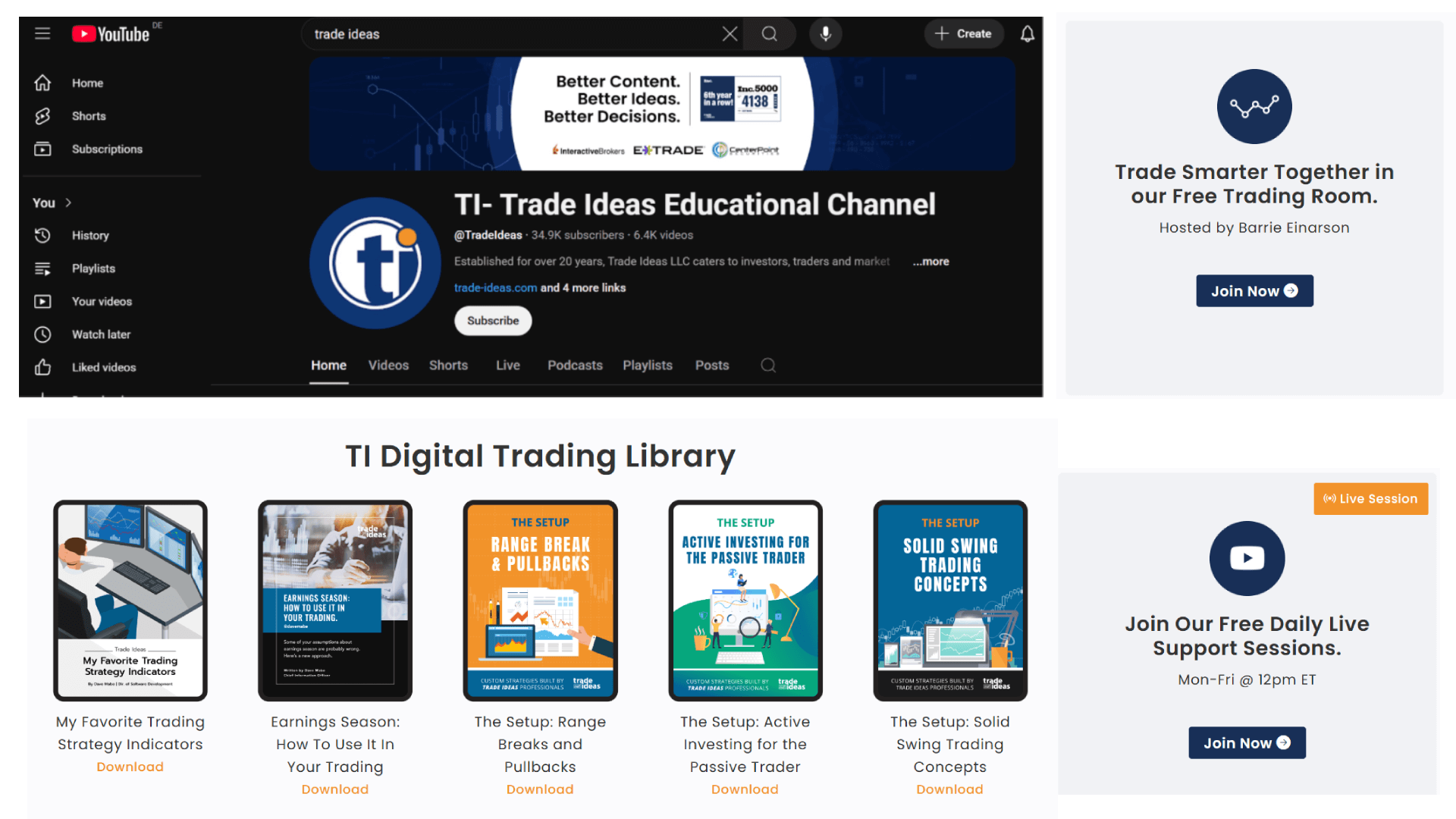

- Watch the “Getting Started” videos – Trade Ideas education resources include a comprehensive YouTube channel with tutorials. The videos from TI University cover everything from basic scanner setup to advanced strategies.

The trading experience improves dramatically once you understand the Channel Bar system. Instead of building everything from scratch, you can switch between pre-configured layouts for gap trading, momentum plays, or low float stocks with a single click.

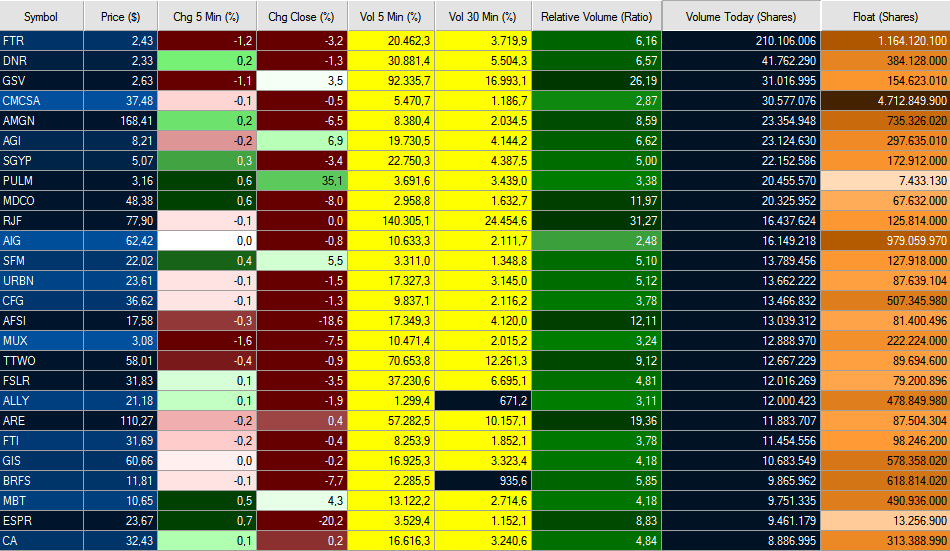

The Stock Scanner: Why This Thing Actually Delivers

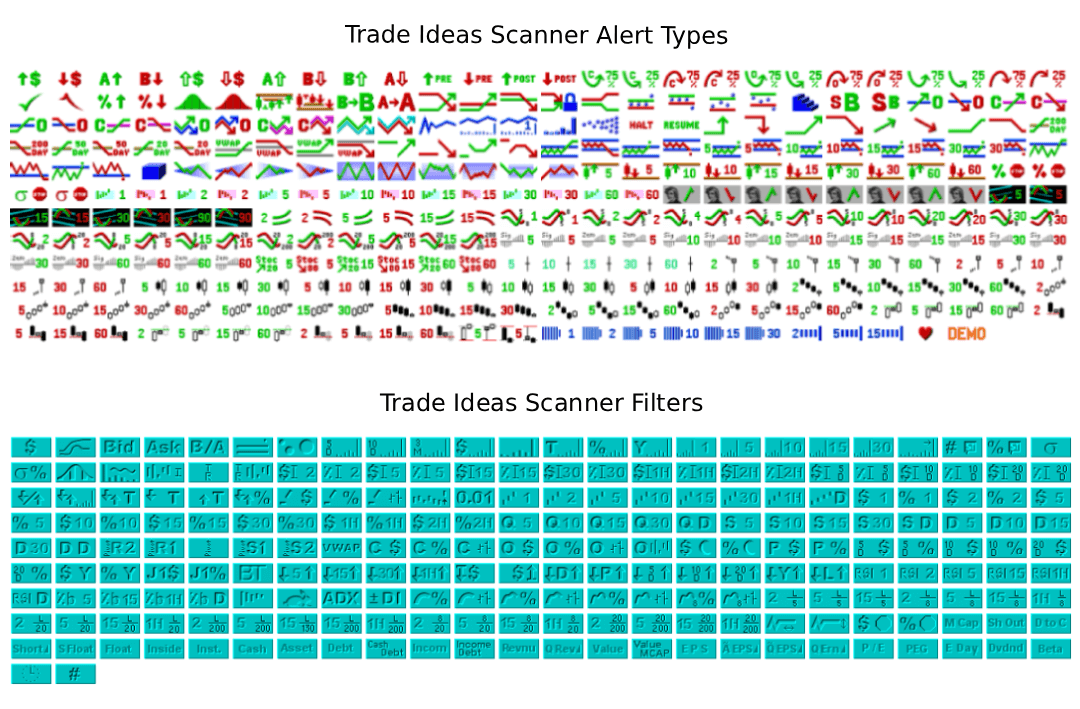

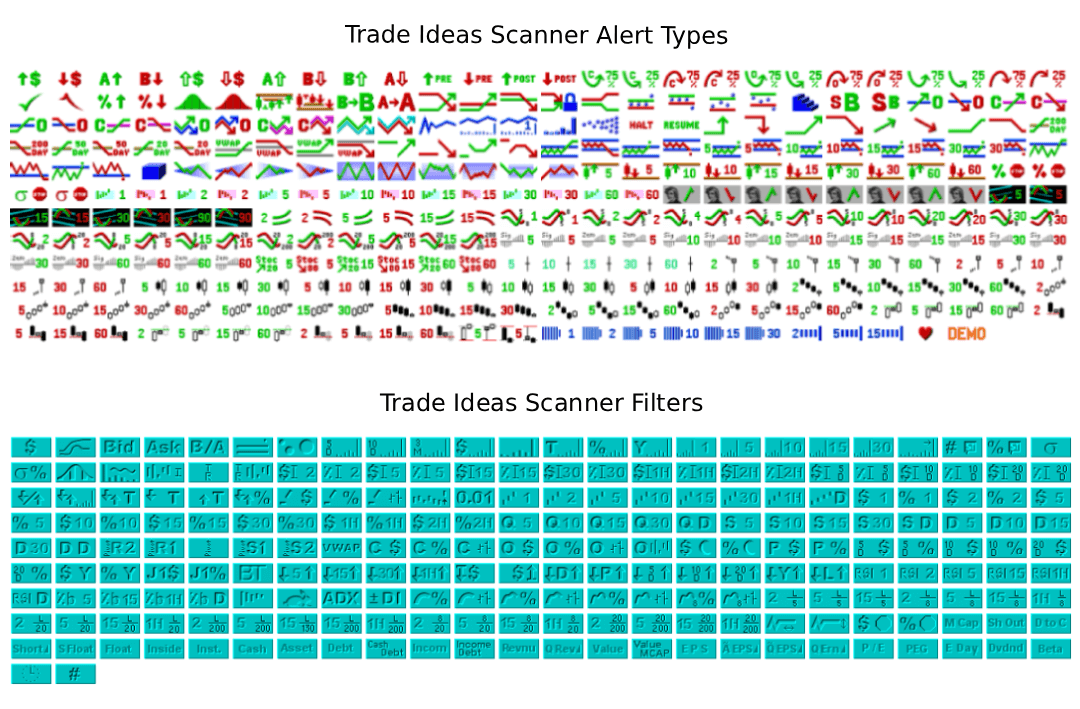

Over 500 Filters and Alert Types (No, Seriously)

The Trade Ideas scanner is where this platform absolutely shines. I’m talking about over 500 different filters and trade alert types. Want to find stocks gapping up by at least 10% with minimum pre-market volume of 100,000 shares? Done. Want to scan for Fibonacci retracements happening in real-time during market hours? Done. Want to find low float stocks making new 52-week highs with RSI divergence? Absolutely.

Here’s what I love about this: you don’t need to code anything. Most stock screeners make you write Python or C# scripts to create complex scans. Trade Ideas? You just click the filters you want, set your values, and let it run. It’s like Legos for traders, powerful building blocks that anyone can combine.

The Real-Time Speed Problem (That Trade Ideas Solves)

Every trading platform has “screeners,” but here’s the dirty secret: most of them are slow, refresh every few minutes, and miss the actual moves. If your scanner shows you an opportunity 5 minutes after it happened, you’re not trading, you’re bag-holding.

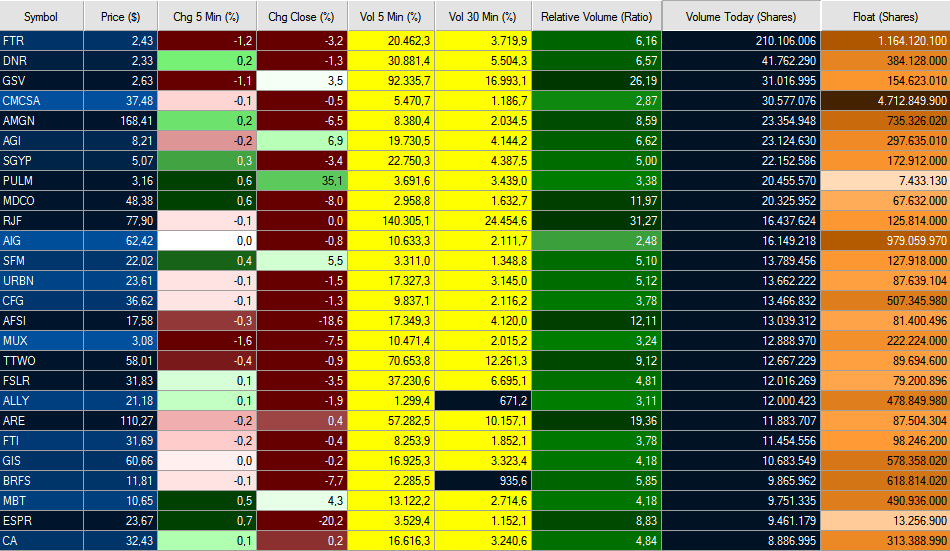

The Trade Ideas scanner runs real-time scans continuously. Not every 30 seconds. Not when you hit refresh. Continuously. This means you see opportunities as they’re developing, not after the move is already over and Twitter is posting about it.

You can run as many scans as you want simultaneously: 10, 20, 50 different scanners all watching different setups. I usually run about 8 different scans at the same time. Gap-ups, high relative volume, new highs, bull flags, you name it. Your computer might hate you, but Trade Ideas handles it.

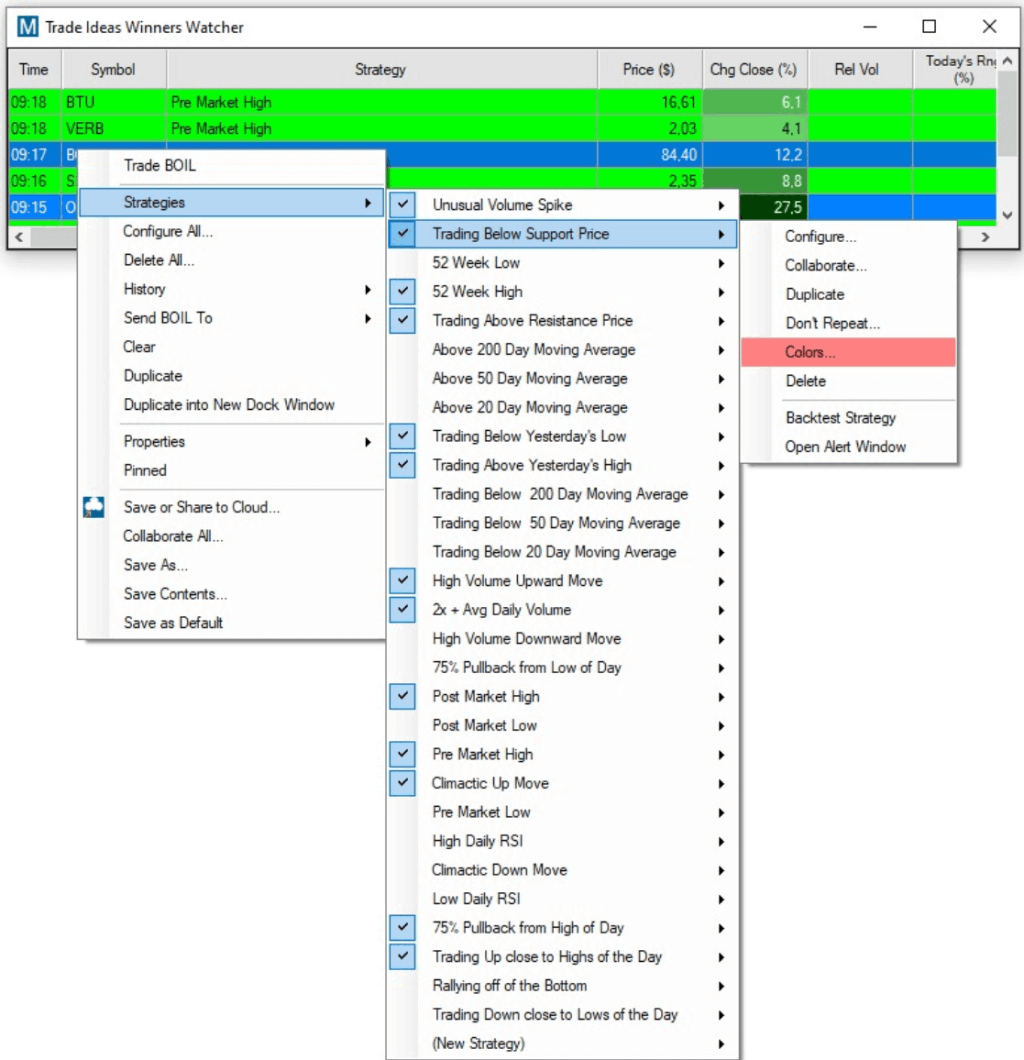

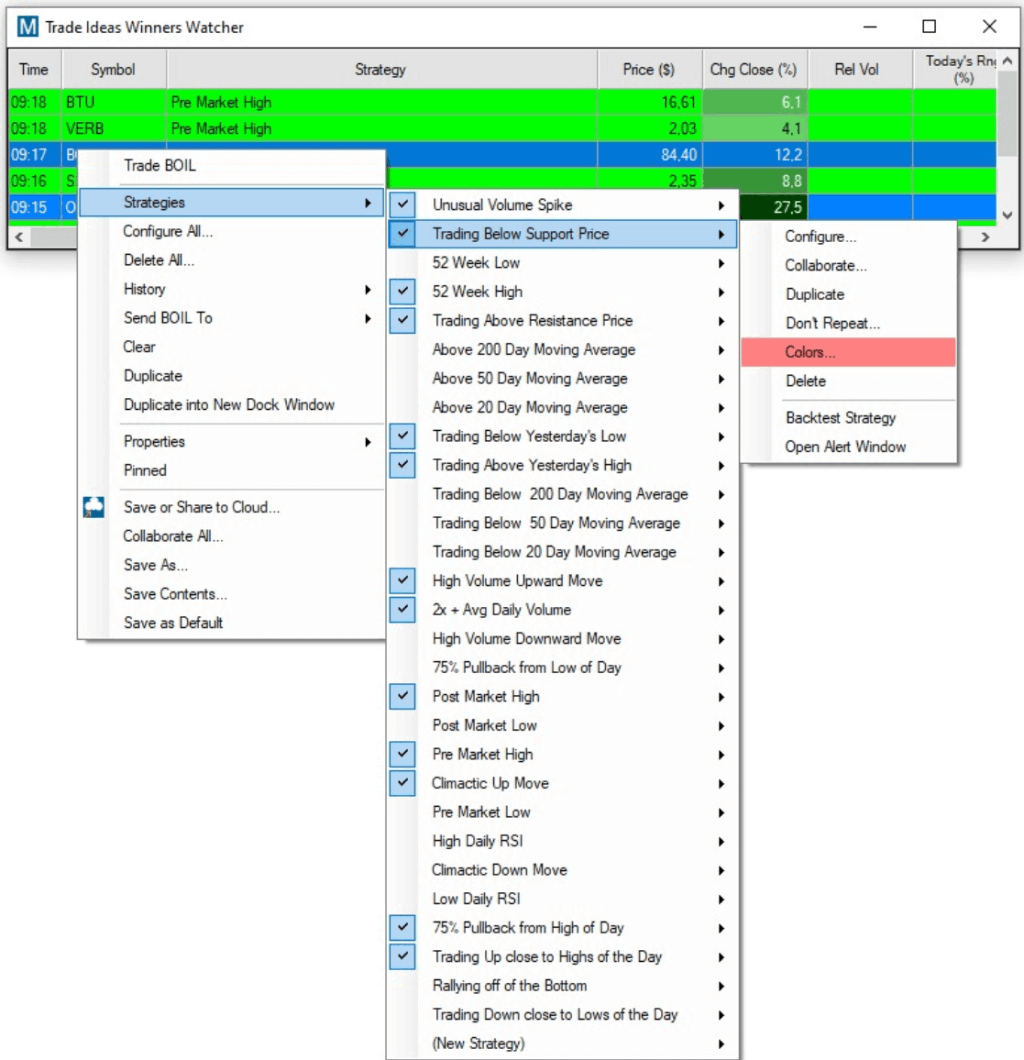

Pre-Configured Scanners (For When You’re Lazy Like Me)

Don’t want to build your own scans? Trade Ideas offers dozens of pre-configured scanners for common setups:

- Top gap-ups and gap-downs – Perfect for pre-market preparation

- Unusual volume movers – Catches momentum before the crowd

- New highs and new lows – Breakout and breakdown opportunities

- Low float stocks – Small float plays with explosive potential

- Opening range breakouts – Classic day trading setups

These alone are worth the subscription price if you’re starting out and don’t know what to look for yet.

The One Big Limitation Nobody Talks About

Here’s something you need to know before subscribing: Trade Ideas only covers US stocks. No European markets. No Asian markets. No crypto. If you’re trading anything outside of Nasdaq, NYSE, or OTC stocks, this platform is useless to you. But here’s the silver lining: all US exchange market data fees are included in your subscription. While competitors like TradingView charge you extra for real-time data from each exchange, Trade Ideas bundles everything into one price. So you’re not getting nickel-and-dimed with $10/month here, $15/month there for data feeds.

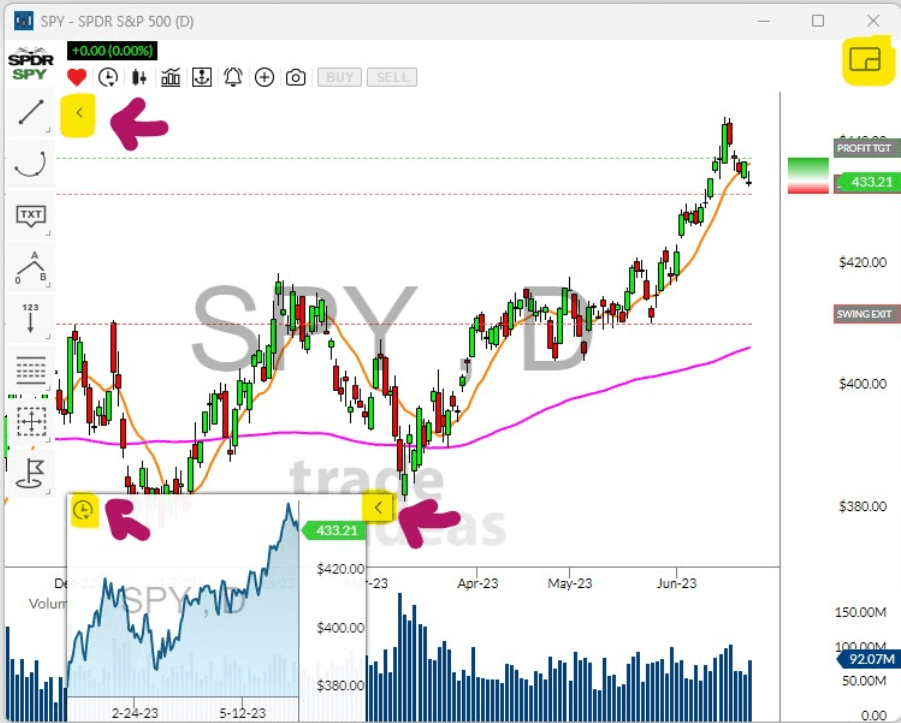

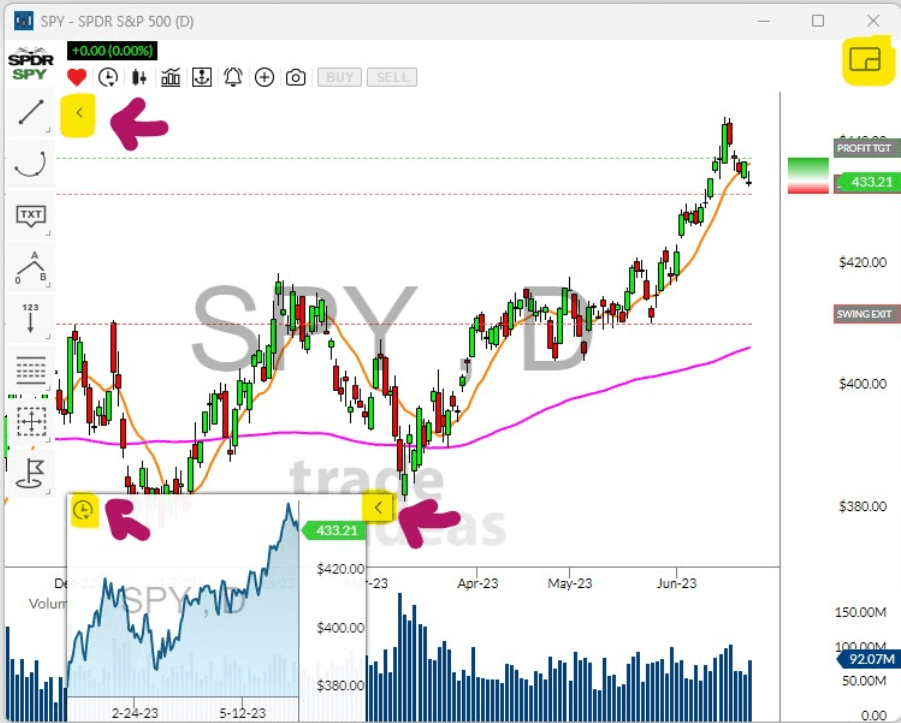

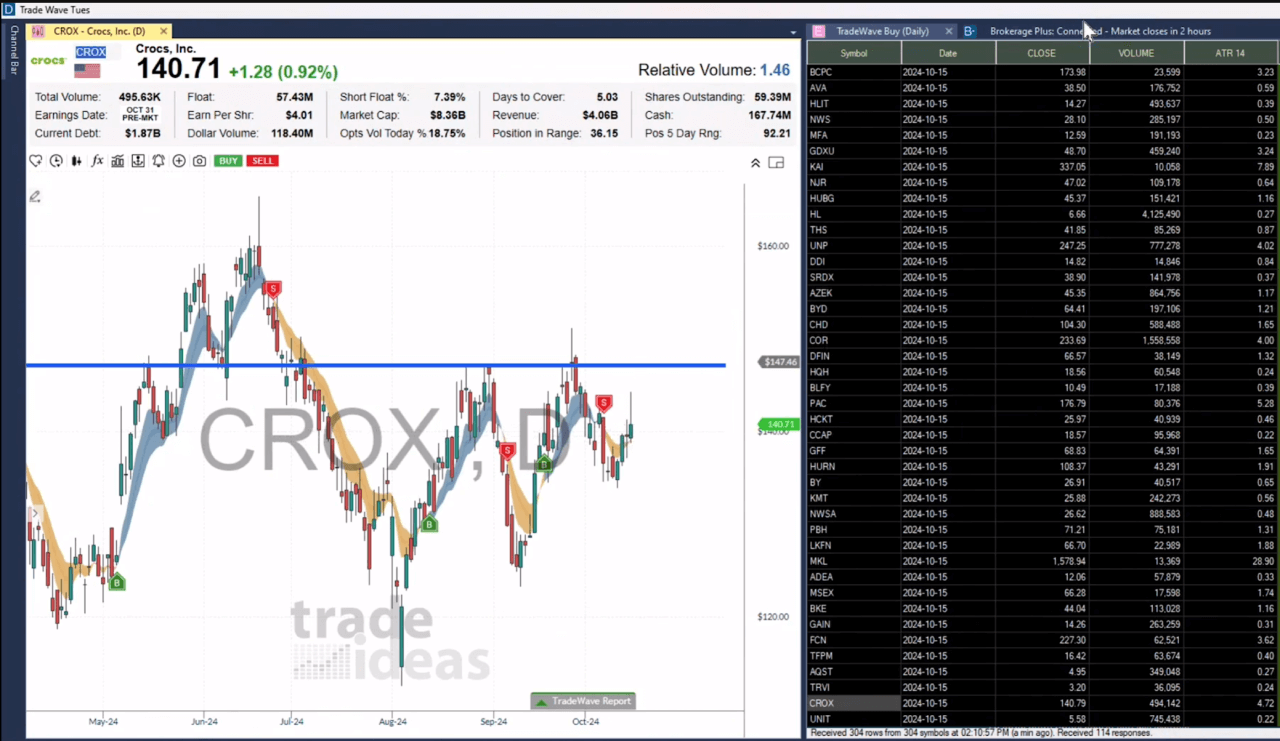

The Charts: Good Enough, Not Great

Trade Ideas charts are fine. They’re connected directly to your scanner results, which is convenient: you can click through stocks in your scan and the charts update instantly. Time frames start at one minute (perfect for day trading), and you get all the basic indicators you’d expect: VWAP, volume, moving averages, RSI, etc.

You can annotate charts and draw trend lines, and prices are real-time. But let’s be real: if you’re coming from TradingView or TrendSpider, Trade Ideas charts will feel basic. They get the job done, but they’re not why you’re buying this platform.

My setup: I use Trade Ideas for scanning and identifying opportunities, then switch to TradingView for detailed technical analysis. Works perfectly. Many professional traders I know run multiple monitors, Trade Ideas on one screen for scanning, TradingView on another for charting, and their broker platform on a third for execution.

The AI Features: HOLLY Is Actually Legit

First-Gen AI: HOLLY (Been Around Since 2016)

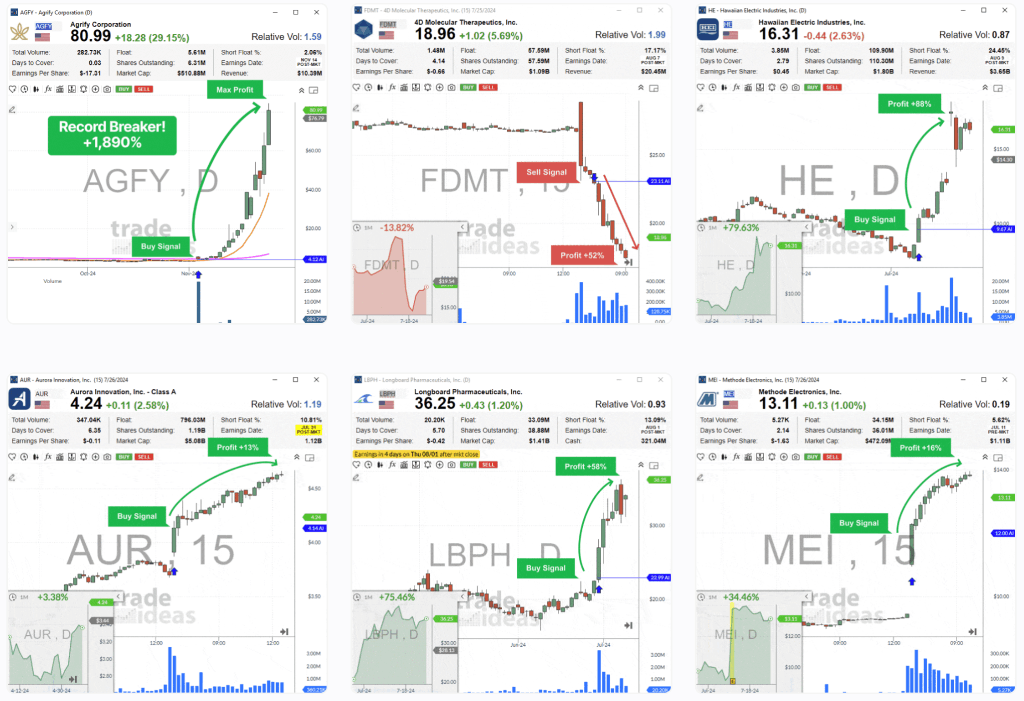

Let’s talk about what everyone asks about: the AI. Trade Ideas launched HOLLY (their first-generation artificial intelligence system) back in 2016, way before ChatGPT made AI the buzzword of the decade. And here’s the thing, it actually works.

HOLLY AI automatically identifies trade entry and exit points based on probability analysis. It’s not magic, and it’s not going to make you rich overnight, but it genuinely found trade ideas I would have missed. The AI monitors thousands of stocks, identifies patterns that have historically worked, and gives you specific entry prices, stop losses, and profit targets.

What I really appreciate: HOLLY AI tracks every trade recommendation. So even if you log in late, you can review what HOLLY recommended earlier in the trading day, see what worked, what didn’t, and learn from it. This accountability is rare in trading software, most platforms want to show you only the winners.

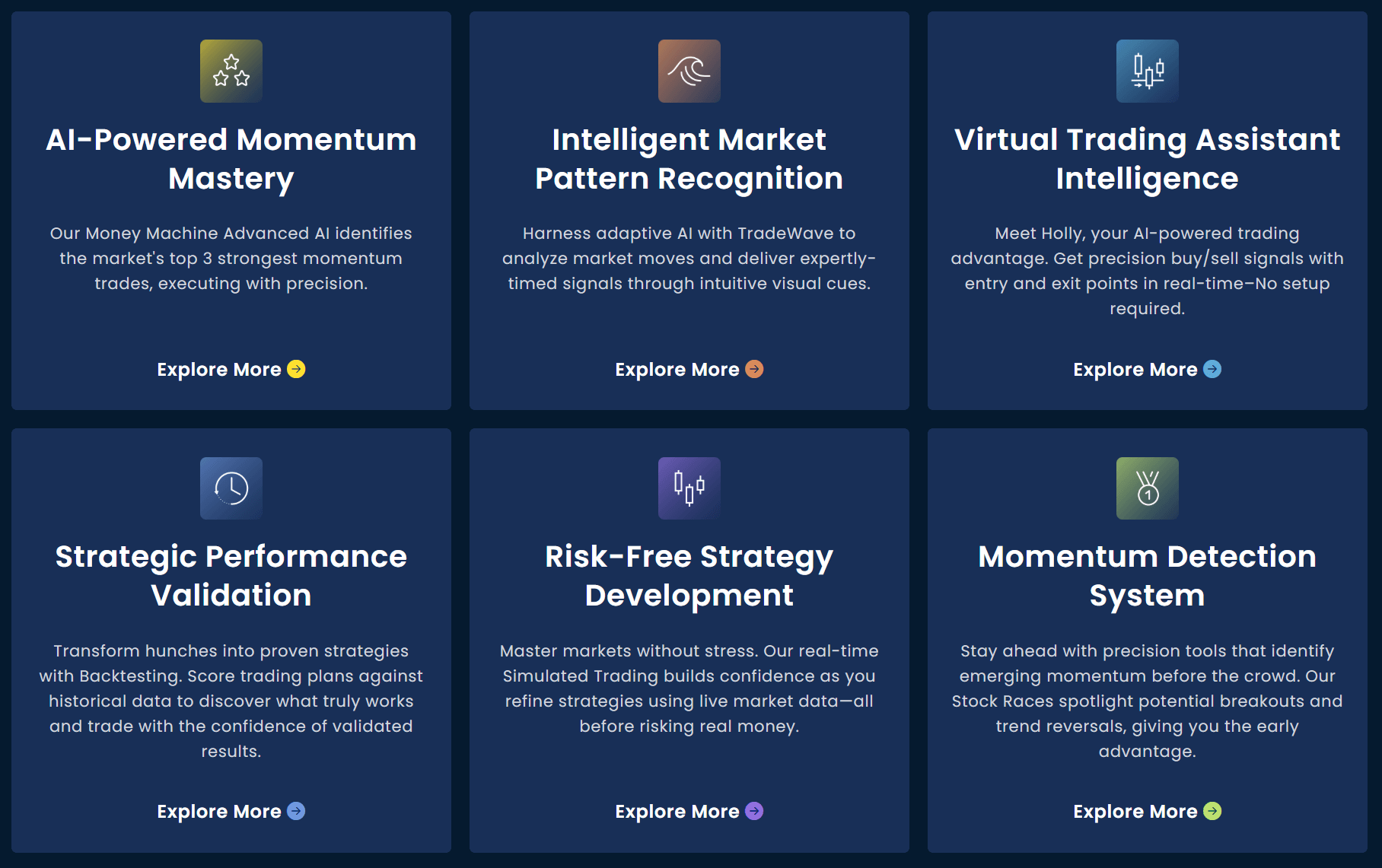

The Three Versions of HOLLY AI

Trade Ideas Premium subscribers get access to three different HOLLY AI systems, each with distinct trading strategies and risk profiles:

- Holly Grail – Conservative approach, higher win rate, smaller gains

- Holly 2.0 – Balanced risk/reward with momentum focus

- Holly Neo – Aggressive plays, lower win rate, bigger potential gains

Each AI system analyzes new market data continuously and updates its strategies based on current market direction. The newest feature, called Money Machine, even has auto trading capability where it can execute trades automatically based on real-time performance metrics rather than just hitting predetermined price targets.

I haven’t used the full auto trading yet (still too much of a control freak), but the paper trading results are impressive. The Money Machine represents a legitimate AI trading platform that goes beyond simple scanning, it’s actual algorithmic execution.

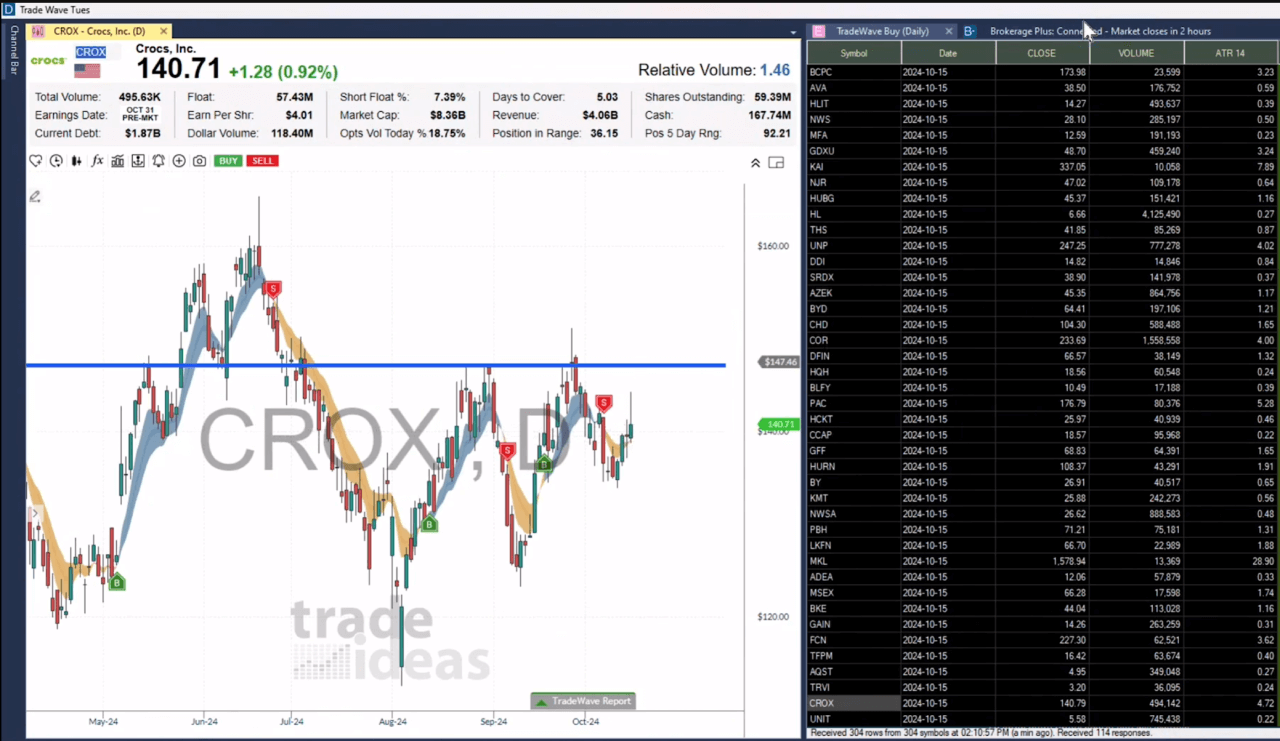

TradeWaves: The Visual Buy/Sell Signal System

TradeWaves is Trade Ideas’ visual indicator system that overlays colored bands on your charts based on exponential moving averages (EMAs). Green means trending up, red means trending down. Sounds simple, and it is, but simple often works in trending markets.

I use TradeWaves as a confirmation tool rather than my primary signal. When HOLLY AI or my custom scans find a stock, I’ll check TradeWaves to see if the trend aligns. It’s particularly useful in choppy trading scenarios when you need that extra confirmation before pulling the trigger.

Education and Support: Better Than Expected

I’ll be honest, I didn’t expect much from the educational resources, but Trade Ideas education delivers. You get:

- Comprehensive written guides for every feature

- YouTube video tutorials (surprisingly well-produced)

- Live trading room sessions where experienced traders walk through setups

- Regular webinars covering platform features and strategies

- TI University courses for deeper strategy development

The live trading room alone is worth something. It’s not just promotional nonsense, real active traders share their scans, discuss setups in real-time, and answer questions in the chat room. I’ve picked up several scanner configurations just from watching what professional traders build during the trading week.

The community aspect is genuinely valuable. Whether you’re looking for short trade ideas, swing setups, or just want to see how serious traders navigate different trading styles, the chat rooms provide valuable information you won’t find elsewhere.

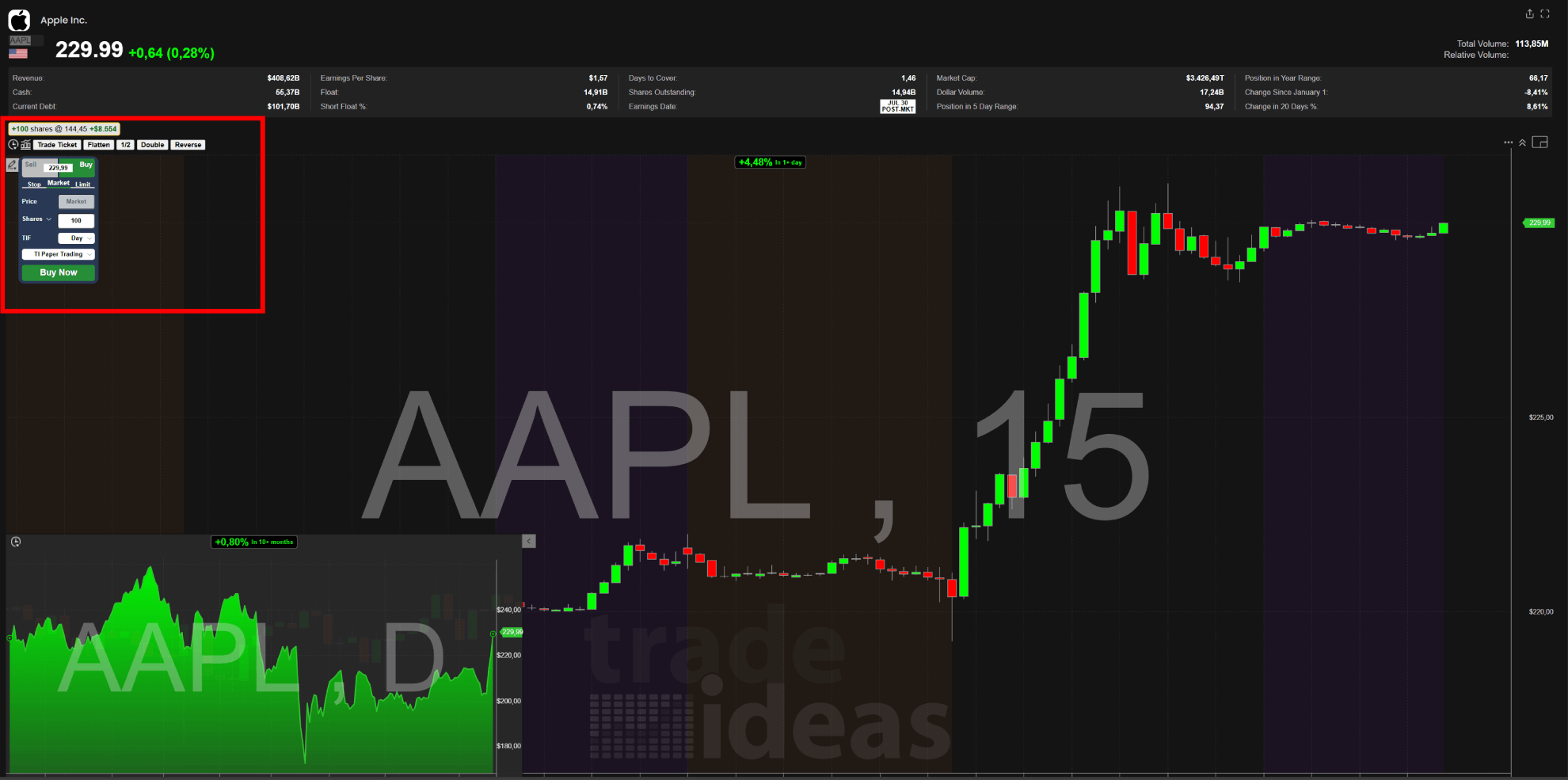

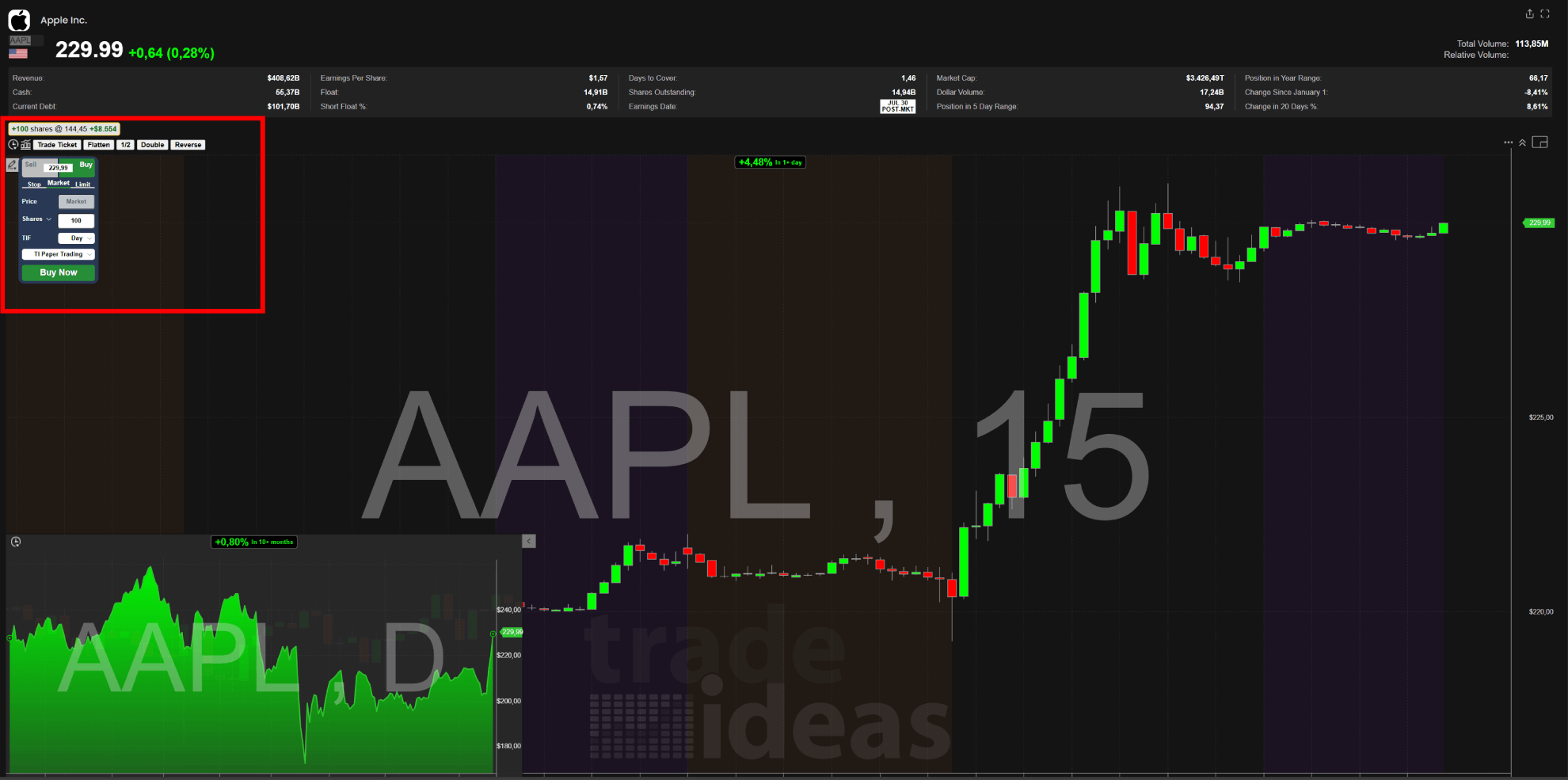

Direct Broker Integration: Trade From the Platform

One feature that surprised me: you can actually trade directly from Trade Ideas. Most scanners just find opportunities and then you manually enter trades in your broker platform. The Trade Ideas platform can connect to Interactive Brokers and E*TRADE through its Brokerage+ feature, letting you place orders right from the chart.

You can:

- Click buy/sell buttons directly on the chart

- Use a simple trading DOM (depth of market display)

- Let AI trade alerts automatically trigger orders in your brokerage account

- Execute trades automatically based on HOLLY AI signals

I still prefer to manually enter most day trades (trust issues with automation), but for traders who want a more streamlined active trading workflow, this integration is genuinely useful. The ability to execute trades automatically is a game-changer for traders who’ve backtested their strategies and trust the AI trading signals.

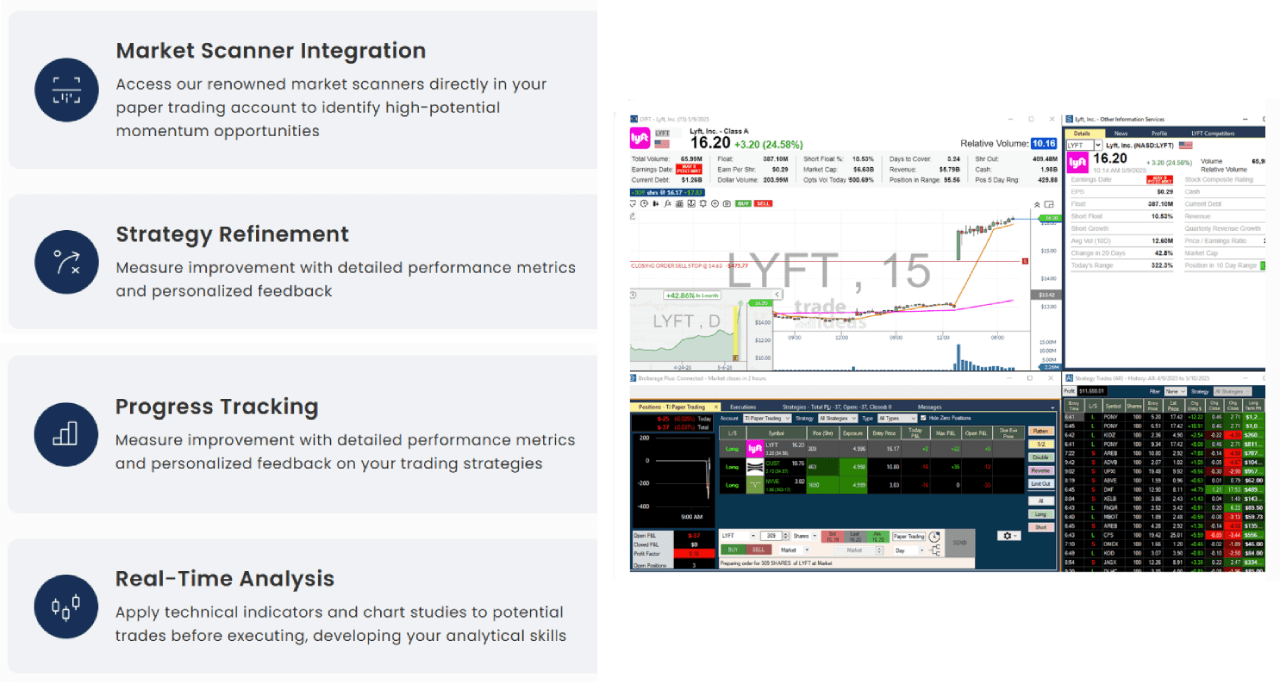

Paper Trading & Backtesting: Practice Before You Lose Money

The Simulator That Actually Works

Trade Ideas offers a complete paper trading simulator, which is huge because many platforms charge extra for this. You can test your trading strategies, follow AI alerts, and see how you’d perform, all with fake money and real market conditions.

This is perfect for:

- Testing new scanner configurations before risking real money

- Following HOLLY AI recommendations to see if they match your trading style

- Practicing with pre-market and after-hours opportunities

- Building confidence as a better trader before going live

I spent my first month with Trade Ideas purely in simulation mode, which saved me from several stupid mistakes I definitely would have made with real money. New traders especially should spend at least 2-3 weeks in paper trading mode before risking capital.

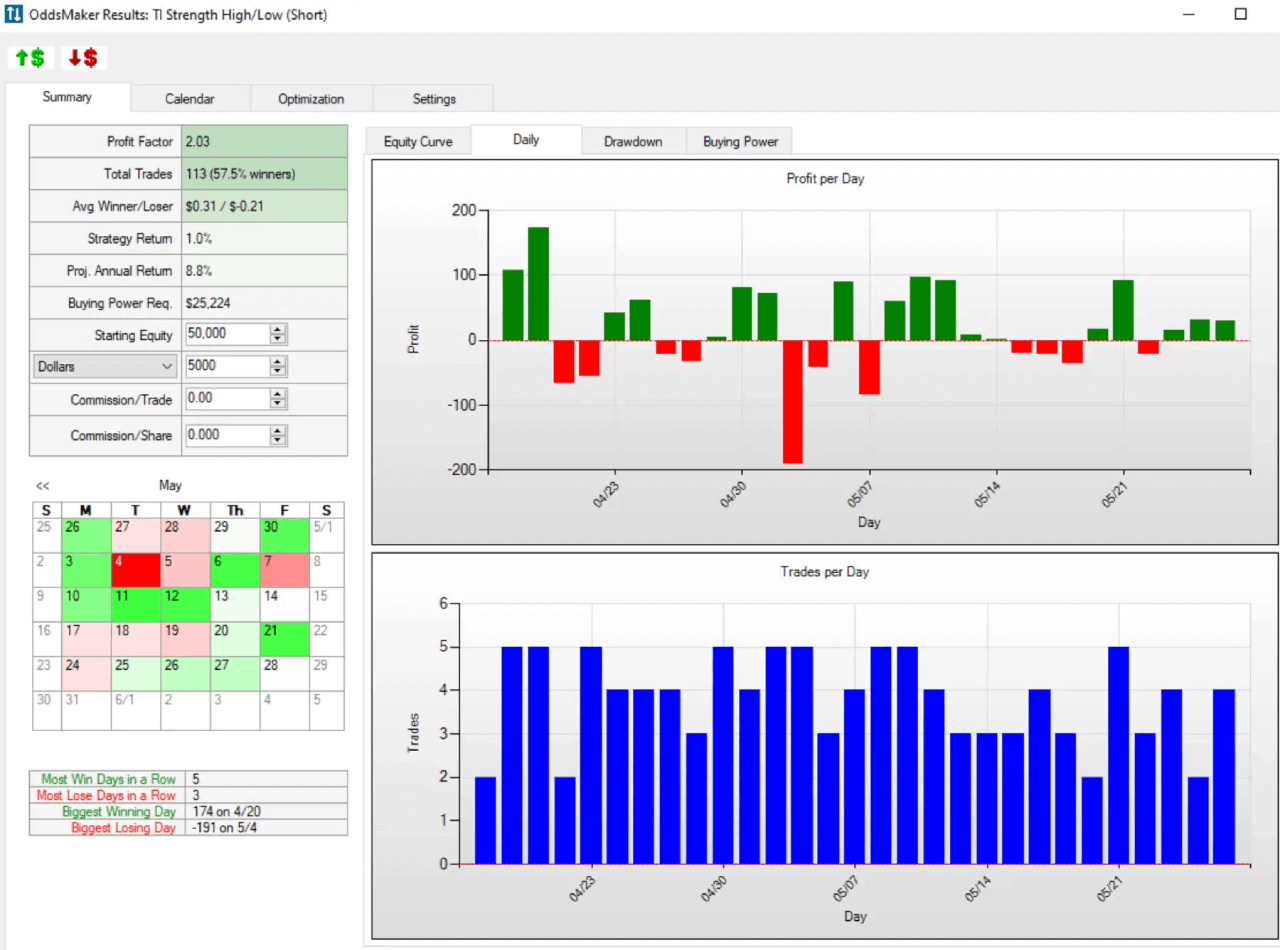

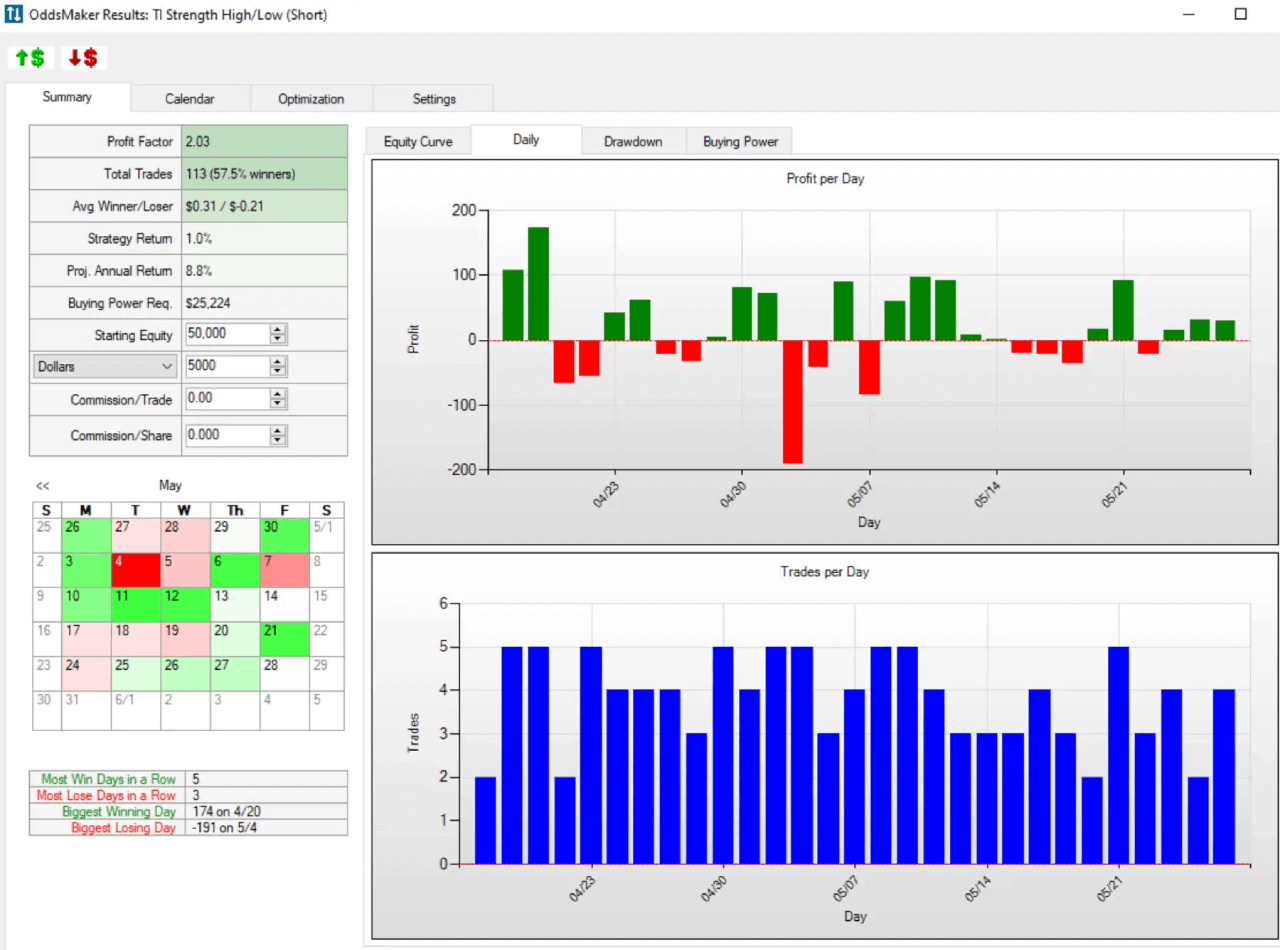

OddsMaker: The Backtesting Engine

Want to know if a strategy actually works before trading it? The OddsMaker backtesting module lets you test any scanner setup or trading strategy against historical market data with a single click.

You can:

- Test strategies across different time periods

- Optimize entry signals and sell signals for maximum performance

- See exactly how often your setup wins or loses

- Analyze which market conditions favor your trading strategies

- Compare different trading scenarios side by side

This level of backtesting used to require expensive specialized software. Having it built into the Trade Ideas platform is legitimately game-changing for strategy development. Professional traders spend hours in OddsMaker optimizing their approaches before deploying them with real capital.

What’s This Actually Going to Cost You?

Alright, let’s talk money. The Trade Ideas subscription isn’t cheap, but the pricing is at least straightforward (unlike some platforms I could name).

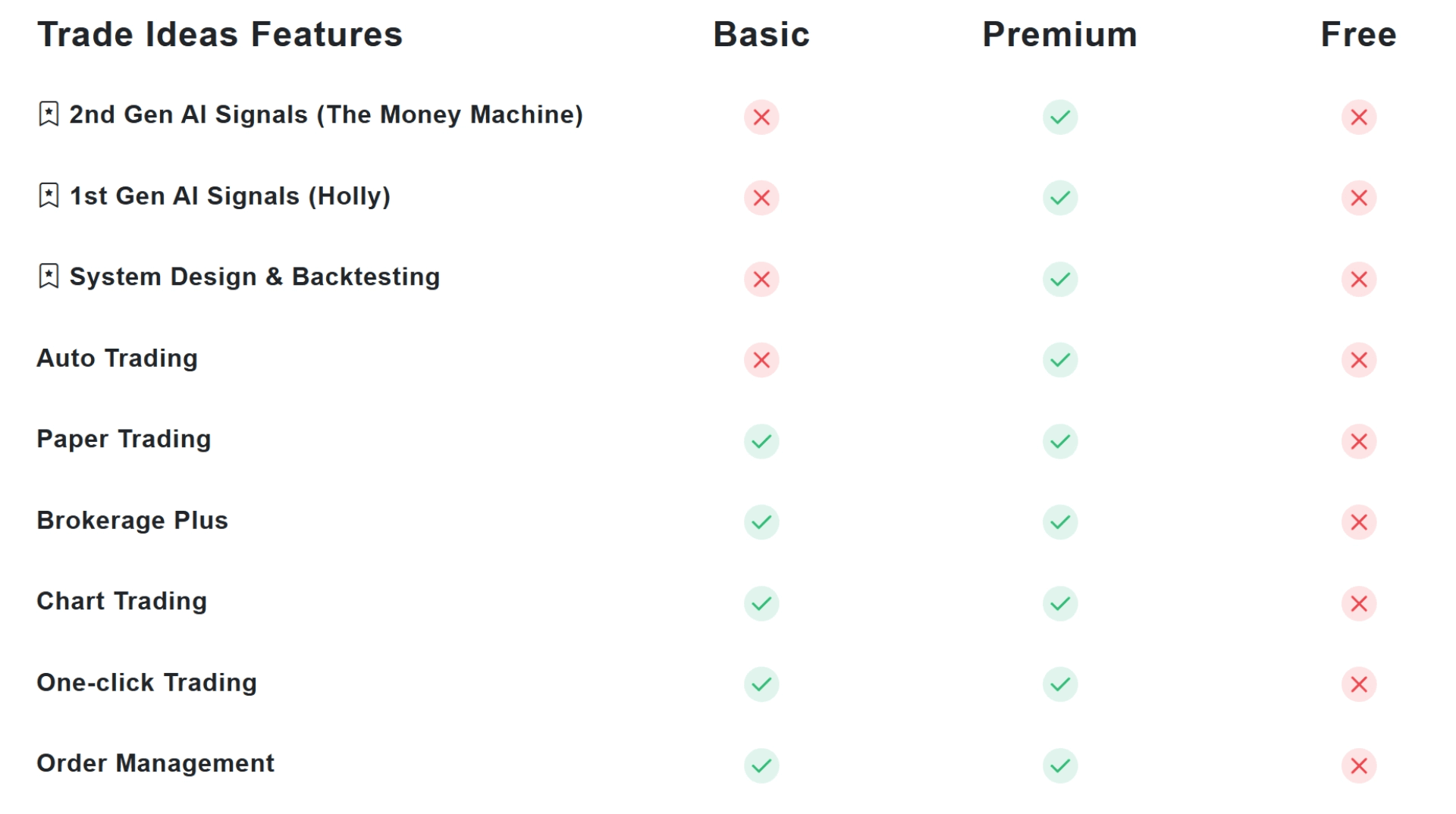

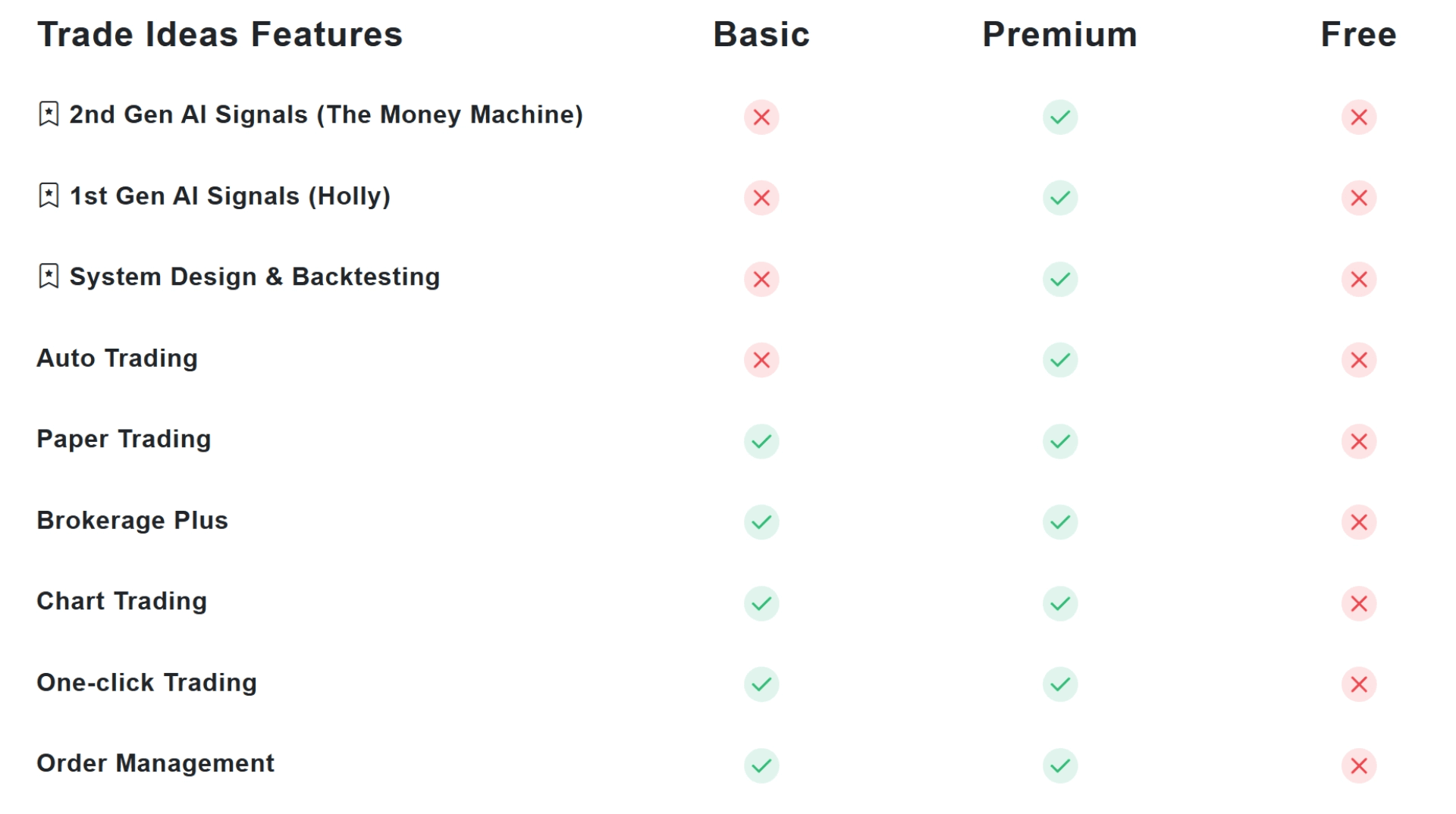

Basic Plan: $127/Month or $1,068/Year

The Basic plan includes:

- Real-time stock scanning with 500+ filters

- Multiple simultaneous scanners

- Live trading room access

- Charting tools with real-time data

- Paper trading simulator

- Pre-configured scanner templates

- Formula editor for custom scans

- All US market data feeds included (no extra data fees!)

- Access to the Channel Bar with curated layouts

- Multiple windows for multi-monitor setups

Who this is for: Day traders who primarily need scanning and alerting. If you’re comfortable developing your own trading strategies and don’t need AI hand-holding, Basic has everything you need.

Premium Plan: $254/Month or $2,136/Year

Trade Ideas Premium adds:

- 1st Gen AI (HOLLY AI) trading signals, all three versions

- 2nd Gen AI (Money Machine) with auto trading capability

- Full backtesting with OddsMaker

- Smart risk levels for position sizing

- Enhanced Channel Bar with advanced templates

- TradeWaves indicator

- Advanced broker integration through Brokerage+

- More customization options for the desktop platform

- Priority support from the Trade Ideas team

Who this is for: Traders who want AI assistance, need backtesting capability, or want the most advanced features. If you’re making $10,000+ per month from day trading, the Premium upgrade is a no-brainer.

Free Plan: Worth Checking Out

There’s a free version called the Par plan that gives you access to the web version with delayed data. It’s basically a demo to see if you like the interface before committing. Don’t expect to actually day trade with it, but it’s useful for kicking the tires.

The Hidden Costs (That Aren’t Really Hidden)

Unlike some platforms, Trade Ideas doesn’t hit you with surprise fees:

- ✅ All US market data included (this alone saves $40-60/month vs other platforms)

- ✅ No per-trade execution fees (those come from your broker)

- ✅ No limits on number of scans or alerts

- ❌ Add-ons cost extra (AVWAP and GoNoGo are $49/month each)

Pro tip: Use an annual subscription and my discount codes to save 15-30%. On Premium, that’s $320-600 in savings. On Basic, it’s $160-290 saved. The annual plan always provides better value than paying monthly.

The Add-Ons: Worth It or Skip It?

Trade Ideas Add-Ons

Trade Ideas offers two optional add-ons at $49/month each. Both require an active Basic or Premium subscription.

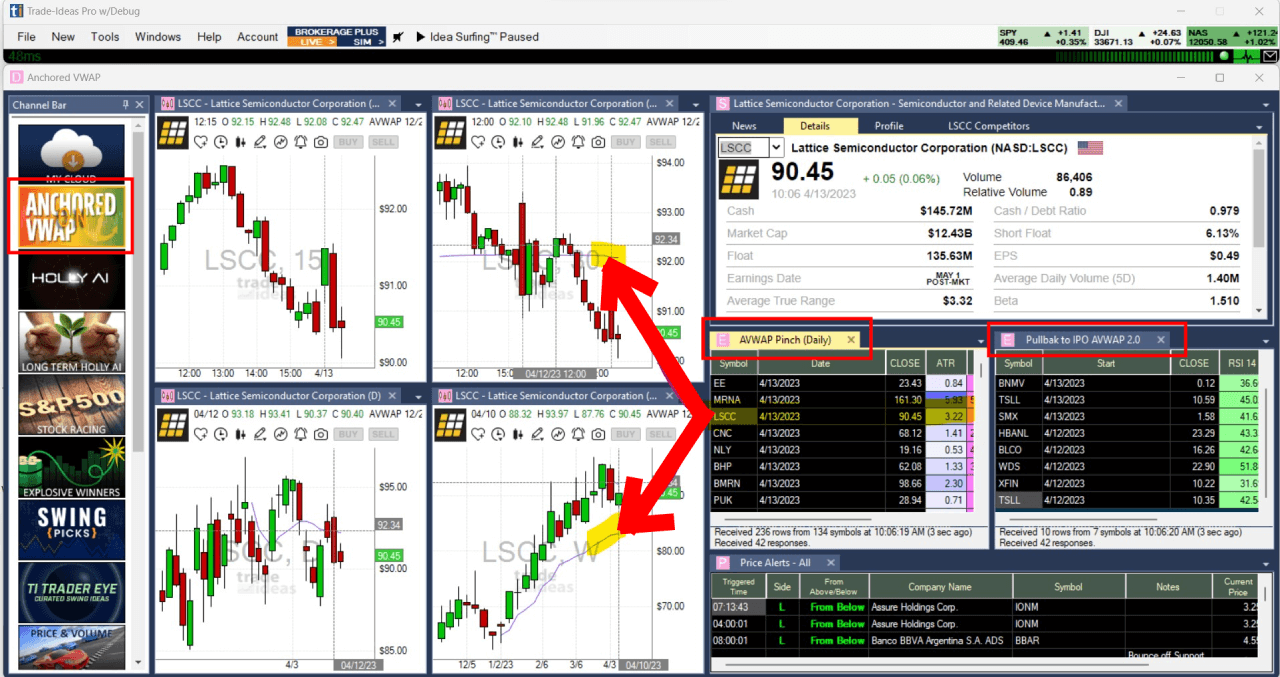

AVWAP (Anchored VWAP): For Volume Traders

AVWAP stands for Anchored Volume Weighted Average Price, based on Brian Shannon’s methodology. Trade Ideas automatically:

- Draws AVWAP Pinch setups

- Finds stocks pulling back to anchored VWAP levels

- Scans for AVWAP IPO setups in real-time

My take: If you actively trade VWAP strategies and it’s core to your trading style, this add-on is excellent. If you don’t, it’s $49/month you don’t need to spend. I use VWAP in my technical analysis, but I manually draw anchored levels rather than paying for automation.

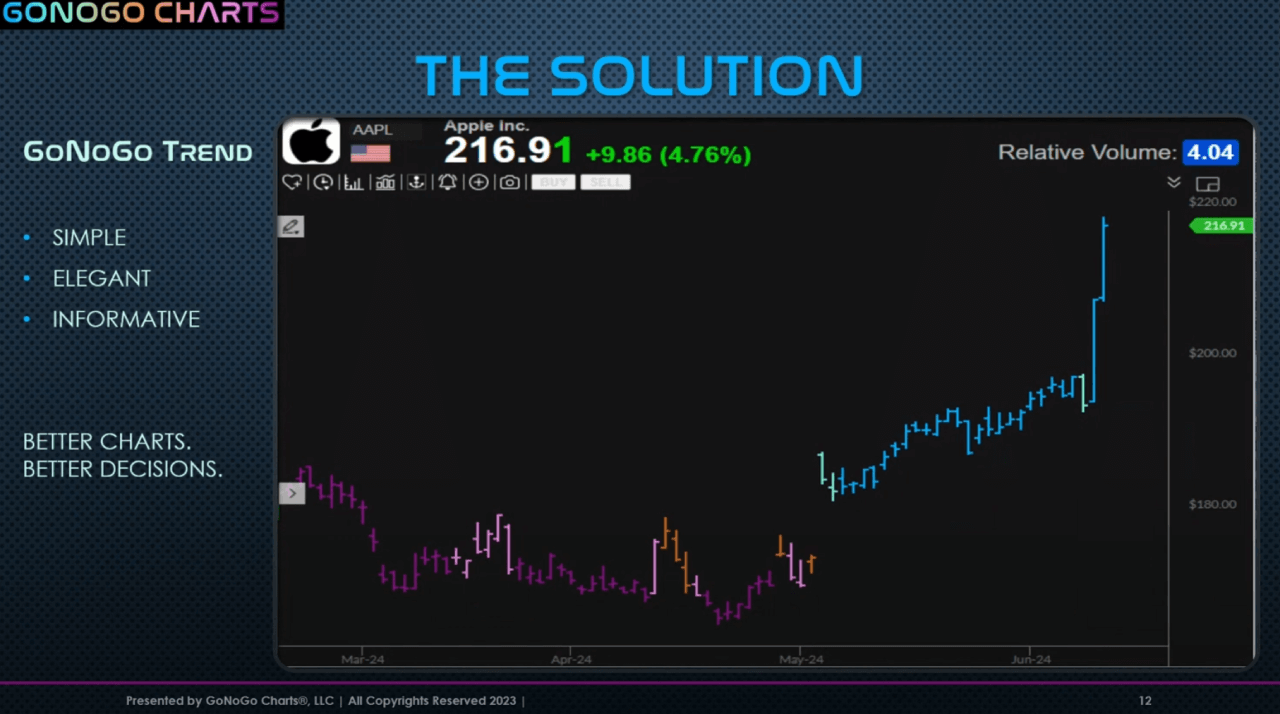

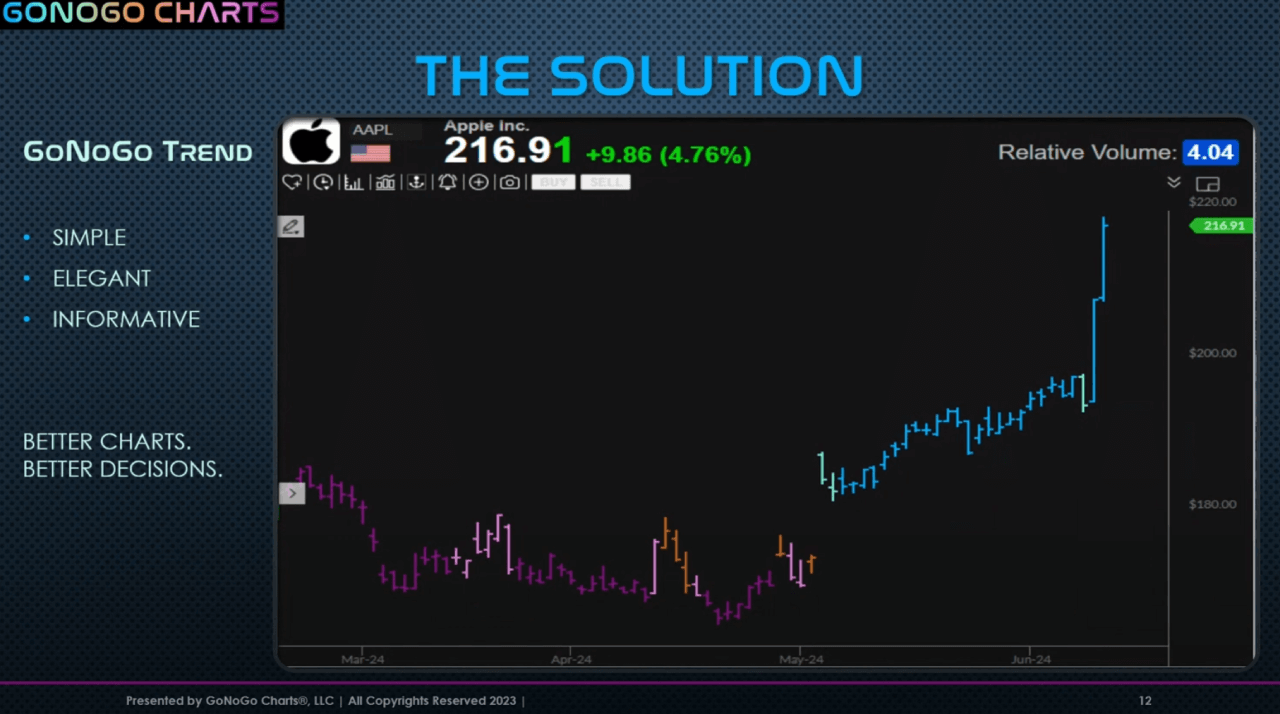

GoNoGo Charts: Simplified Trend Visualization

GoNoGo overlays color-coded trend indicators on your charts: green for uptrends, red for downtrends, neutral for sideways chop. It’s designed to remove ambiguity about market direction.

My take: It’s pretty, and it works, but I don’t personally find it worth $49/month. TradeWaves (included in Trade Ideas Premium) does something similar. Unless you’re specifically a GoNoGo methodology trader, skip this one.

What I Genuinely Love About Trade Ideas

After months of daily active trading with this platform, here’s what keeps me subscribed:

The scanning speed is unmatched. I’ve tested FinViz, TradingView, Stock Rover, and broker platforms. Nothing comes close to Trade Ideas for real-time alerting. When a stock gaps up and starts moving, the Trade Ideas scanner tells me immediately, not 2 minutes later when the move is already over.

The customization depth is insane. If you can imagine a scan, you can probably build it. I have scanner setups for gap-and-go plays, VWAP reversals, breakouts from consolidation, unusual options activity, average volume spikes, and about 15 other specific setups. Each scanner watches the entire market simultaneously.

The HOLLY AI actually works. I was skeptical about AI trading signals initially (I’ve seen enough “AI” marketing bullshit to last a lifetime), but the trade recommendations are solid. It doesn’t win every time, nothing does, but the win rate is good enough that I pay attention when HOLLY flags something. The platform has genuinely found trade ideas I would have otherwise missed.

Real-time data is included. This is huge. Other stock screeners charge $10-15 per exchange per month for real-time data. Trade Ideas bundles everything into one price. If you’re comparing costs, factor in the market data fees you’re saving.

The community is helpful. The trading room isn’t just promotional fluff, real traders share real setups. I’ve learned new trading strategies just from watching what active traders build during the trading week in the chat rooms.

Paper trading is included. Being able to test strategies with zero risk before committing real capital is invaluable, especially when trying new scanner setups or following AI trading signals. New traders can spend months developing their trading experience in simulation mode.

The Channel Bar saves time. Instead of rebuilding your workspace every trading day, you can switch between pre-configured layouts instantly. Gap scanners in the morning, momentum scans midday, swing setups in the afternoon, all one click away.

What Could Be Done Better

Nothing’s perfect. Here’s what annoys me about Trade Ideas:

The price is steep. $127/month minimum is a lot, especially for newer traders. And Trade Ideas Premium at $254/month? That’s $3,000+ per year. You need to be making decent money from day trading for this to make financial sense.

The interface feels dated. The desktop platform works great functionally, but visually it looks like it was designed in 2010. It’s not ugly, just… not modern. The web version is slightly better but still behind platforms like TradingView in terms of visual polish.

The learning curve is steeper than expected. Trade Ideas markets itself as user-friendly, and compared to coding your own scanners it is. But there are so many features and options that new traders often feel overwhelmed. Expect to spend at least a week learning the platform before you’re comfortable. Trade Ideas education helps, but there’s still a lot to absorb.

Charts are basic. If you’re coming from TradingView or TrendSpider, Trade Ideas charts will disappoint you. They work fine for quick technical analysis alongside scanner results, but they’re not a replacement for dedicated charting software.

US stocks only. If you trade international markets, crypto, or futures, Trade Ideas won’t help you. It’s strictly US equities (Nasdaq, NYSE, OTC).

Mobile app is limited. There’s a mobile app, but it’s basically for checking alerts and viewing scanner results. You can’t build complex scans or use most advanced features on mobile. This is a desktop platform designed for professional traders with multiple monitors.

No refunds on annual subscriptions. If you pay for a full year and decide you hate it after 2 months, tough luck. This is why I recommend starting with monthly billing until you’re sure the trading experience fits your needs.

Who Should Actually Use Trade Ideas?

Trade Ideas is Perfect For:

- Active traders who make 3+ day trades per trading week

- Momentum traders looking for gap-ups, volume spikes, and breakout setups

- Pattern traders who want to scan for specific technical formations in real-time

- AI-curious traders who want algorithmic assistance without learning to code

- US stock traders who need comprehensive market coverage in one platform

- High-volume scanners who want to run dozens of different scans simultaneously

- Serious traders whose trading income justifies the Trade Ideas subscription cost

- Professional traders who value time and need the fastest real-time alerts

- Low float specialists who hunt for small cap and low float stocks with explosive potential

Skip Trade Ideas If:

- You trade casually (few times per month), the cost won’t justify the benefit

- You’re primarily a long-term investor, fundamental screening tools are better

- You trade international markets, Trade Ideas is US-only

- You’re just starting out, cheaper platforms exist for learning the basics

- You prefer fundamental analysis, Trade Ideas is built for technical traders

- You need advanced charting, TradingView or TrendSpider are better chart platforms

- You’re on a tight budget, $127/month is a lot when you’re not profitable yet

How Much Can a Day Trader Make with $1,000?

This is one of the most common questions I get, and it ties directly into whether Trade Ideas is worth the investment.

Here’s the brutal truth: most day traders lose money, especially in their first year. But with the right tools, proper risk management, and consistent strategy execution, a skilled day trader can potentially grow a $1,000 account.

Realistic expectations with $1,000:

- Conservative goal: 2-5% per month ($20-50/month)

- Aggressive goal: 10-20% per month ($100-200/month)

- Expert traders: Can occasionally achieve 30%+ monthly returns, but this isn’t sustainable long-term

The challenge with a $1,000 account is that you’re limited by the Pattern Day Trading (PDT) rule unless you’re only taking 3 day trades per trading week. This is where Trade Ideas can help, by finding the highest probability setups, you can make those 3 weekly trades count.

Here’s where Trade Ideas helps:

- HOLLY AI filters thousands of stocks to find the best daily opportunities

- Real-time scanning catches momentum moves before they’re over

- Backtesting lets you verify strategies before risking capital

- Paper trading allows practice without risking that $1,000

If you’re starting with $1,000, I’d honestly recommend spending your first 3-6 months paper trading with a free version or cheaper platform, learning the basics, and then upgrading to Trade Ideas once you’re consistently profitable in simulation. Don’t spend $127/month on tools when you’re working with a tiny account, invest in Trade Ideas education first, then the tools.

How Does Trade Ideas Compare to the Competition?

Trade Ideas vs FinViz

FinViz is free (or $40/month for Elite). Trade Ideas is $127-254/month. So why pay more?

FinViz strengths:

- Free basic version

- Simple, clean interface

- Great for fundamental screening

- Heatmaps and sector analysis

Trade Ideas strengths:

- Real-time scanning (FinViz refreshes periodically)

- 10x more filter combinations

- AI trading signals from HOLLY AI

- Paper trading and backtesting

- Live trading room with active traders

Bottom line: FinViz is perfect for casual traders and investors. Trade Ideas is for day traders who need real-time speed and advanced features. Different tools for different needs. For pure day trading, Trade Ideas is the better scanner; for stock research and fundamentals, FinViz wins.

Trade Ideas vs TradingView

TradingView starts at free, with Pro plans at $15-60/month. But TradingView is primarily a charting platform with screening as a secondary feature.

TradingView strengths:

- Best-in-class charting with advanced technical analysis

- Massive community with shared scripts and trading ideas

- Works on any device seamlessly

- Much cheaper

- Better for swing trading and position trading

Trade Ideas strengths:

- Superior scanning speed and depth for day trading

- Built for active trading specifically

- AI trade recommendations and trading signals

- Better real-time alerting and streaming trade ideas

- Integrated backtesting with OddsMaker

Bottom line: Most serious traders I know use both. TradingView for charts and technical analysis, Trade Ideas for scanning and finding trading opportunities. They complement each other perfectly. If you have multiple monitors, run both simultaneously.

Trade Ideas vs Stock Rover

Stock Rover is built for fundamental analysis and long-term investing. Completely different use case from what Trade Ideas offers.

Stock Rover excels at financial metrics, company fundamentals, portfolio analysis, and research reports. Trade Ideas excels at real-time technical scanning and day trading setups.

Bottom line: If you’re Warren Buffett, use Stock Rover. If you’re a day trader, use the Trade Ideas platform. If you do both trading styles, you might need both platforms.

Trade Ideas vs Benzinga Pro

Benzinga Pro is built around news-driven trading, with proprietary news feeds and analyst ratings alongside basic screening.

Benzinga Pro strengths:

- Best news feed for traders

- Audio squawk box

- Analyst ratings and upgrades

- Lower cost ($99-299/month depending on features)

Trade Ideas strengths:

- Better technical scanning

- AI trading signals and automated strategies

- More filter options (500+ vs ~50)

- Integrated backtesting

Bottom line: News traders lean Benzinga. Technical traders lean Trade Ideas. Some professional traders subscribe to both, Benzinga for catalyst identification, Trade Ideas for technical confirmation and entry timing.

Is There Anything Better Than Trade Ideas?

The honest answer: for day trading US stocks with AI assistance, no, Trade Ideas is currently the best stock scanner available. But “better” depends on what you need.

Trade Ideas is the best at:

- Real-time scanning speed

- AI-generated trading signals (HOLLY AI, Money Machine)

- Number of filters and customization options

- Integrated backtesting and paper trading

- All-in-one solution for active traders

Other platforms are better at:

- TradingView: Advanced charting and technical analysis

- TrendSpider: Automated pattern recognition

- Stock Rover: Fundamental analysis and long-term research

- Benzinga Pro: News-driven trading and catalyst scanning

- FinViz: Simple screening at low cost

The “best” platform depends on your trading style. For pure day trading with emphasis on momentum, gaps, and technical setups, nothing matches what the Trade Ideas platform delivers. For other trading styles, there may be better options.

Many professional traders use Trade Ideas as their primary scanner but supplement it with other tools. The platform isn’t trying to be everything, it’s specifically optimized for finding and acting on short-term trading opportunities in US stocks.

Is There a Legitimate AI Trading Platform?

Yes, and Trade Ideas is one of the most legitimate AI trading platforms available. Here’s why:

What makes Trade Ideas’ AI legitimate:

- Transparency: HOLLY AI tracks and displays every recommendation, including losers. You can review historical performance.

- Audited results: The platform shows actual entry and exit points with timestamps. No cherry-picking or selective disclosure.

- Multiple AI systems: Holly Grail, Holly 2.0, and Holly Neo offer different risk profiles. You choose based on your trading style.

- Backtesting: OddsMaker lets you verify any strategy against years of market data before trusting it.

- No black box: While you can’t see the exact algorithms, Trade Ideas explains the logic behind signals and what patterns HOLLY AI is identifying.

- 20+ year track record: Trade Ideas has been in business since 2003. Scam AI platforms don’t survive two decades.

What Trade Ideas AI is NOT:

- ❌ A “get rich quick” system that wins every trade

- ❌ A replacement for your own analysis and judgment

- ❌ Suitable for complete beginners who don’t understand basic trading

- ❌ A guarantee of profits (no legitimate platform can promise this)

The artificial intelligence in Trade Ideas is a tool that finds trade ideas and suggests entry/exit points. It’s up to you to validate the setup, manage risk, and execute properly. The AI trading signals work best for traders who already understand technical analysis and can recognize when a HOLLY AI recommendation aligns with their own analysis.

Compared to most “AI trading” platforms that are essentially scams or marketing hype, Trade Ideas represents legitimate AI trading technology developed over decades by a real company in the finance industry.

My Final Verdict on This Trade Ideas Review

After months of daily use, I give Trade Ideas 4.2 out of 5 stars.

Here’s my honest assessment: Trade Ideas is the best real-time stock scanner available for day traders, period. The scanning speed is unmatched, the customization options are overwhelming in a good way, and the AI features actually deliver value. HOLLY AI isn’t magic, but it’s found me profitable setups I would have missed.

But, and this is important, the Trade Ideas platform is expensive specialized software for a specific type of trader. If you’re not day trading US stocks actively, you’re paying for features you won’t use. The basic charts won’t impress anyone coming from TradingView. The learning curve is real. And the cost only makes sense if your trading generates enough profit to justify it.

The Cost-Benefit Calculation is Simple:

- If you’re making $3,000+ per month from day trading → Trade Ideas will likely pay for itself in opportunities found and time saved

- If you’re making $500-1,000/month → Trade Ideas Basic might be worth it, Premium is probably overkill

- If you’re not profitable yet → Focus on cheaper educational resources first, come back to Trade Ideas when you have a proven strategy

My Recommendation:

- Start with the free version (Par plan) to see if the interface works for you

- Subscribe to Basic monthly (not annual) for 2-3 months to test properly

- Track specific trading opportunities Trade Ideas found that you wouldn’t have found otherwise

- Upgrade to Trade Ideas Premium only if you’re using AI trading signals regularly and need backtesting

- Use my discount codes because these subscriptions aren’t cheap

The platform has been around since 2003, which in tech years makes it ancient. They’ve survived multiple market crashes, countless competitor products, and continuous technological shifts. That longevity tells you something, Trade Ideas works, and traders keep paying for it year after year.

Is Trade Ideas perfect? No. Could the interface be more modern? Yes. Should the charts be better? Absolutely. But for real-time scanning of US stocks with the depth and speed day traders need, nothing else comes close to what Trade Ideas offers.

If you’re serious about day trading and ready to invest in professional tools, the Trade Ideas scanner delivers. Just make sure you’re actually the right type of trader for this platform before dropping $127-254 per month on it.

Final Thoughts: Trade Ideas Worth the Investment?

So, is Trade Ideas worth the investment for your trading journey? After testing every aspect of the platform, from HOLLY AI to paper trading to the live trading room, here’s my take:

For active traders who make consistent day trades and need real-time market data scanning across thousands of stocks, a Trade Ideas subscription absolutely provides enough value to justify the cost. The platform’s ability to find trading opportunities you’d otherwise miss, combined with backtesting, AI trading signals, and a supportive community, makes it one of the most comprehensive tools in the finance industry.

For casual traders or those still developing their trading experience, the premium price might be hard to justify. Start with the free version, consider cheaper alternatives, and invest in Trade Ideas education before committing to paid plans.

The Trade Ideas platform isn’t just another stock screener, it’s a complete trading ecosystem designed for serious traders who want to find more money through better setups, faster execution, and smarter trading strategies. Whether it’s worth it depends entirely on your trading style, frequency, and profitability.

Start with my discount codes (PROP15, PROP22, PROP25, PROP28, PROP30) to save 15-30% (15% works always, 22%-30% only during flash sales). Test it thoroughly in paper trading mode, spend time in the trading room learning from professional traders, and decide if this is the right scanner for your trading week. The platform is powerful, but only you can determine if that power is worth the price for your specific trading journey.

hidden – noch am ehesten am original

After spending months testing Trade Ideas, watching it scan through thousands of stocks while I’m still finishing my morning coffee, I can confidently say this is the most powerful stock screener I’ve ever used for day trading. But here’s the catch: it’s expensive, overkill for casual investors, and comes with a learning curve steeper than you’d expect from “just a scanner.”

The Bottom Line: Trade Ideas is the best real-time stock scanner for active traders who need to find opportunities fast among thousands of US stocks. The AI trading signals from HOLLY genuinely work, the scanner speed is unmatched, and the customization options are overwhelming in the best way possible. But if you’re trading a few times a week or prefer fundamental analysis, you’re probably going to hate paying $127-254/month for features you’ll never use.

Prop Firm App is reader-supported. If you click on a link, our partners may compensate us.

Quick Recommendation: Start with the Basic plan ($127/mo) if stock screening is your main need, you get 500+ filters and real-time data included. Go Premium ($254/mo) only if you’re serious about AI signals and backtesting. And for the love of everything, use my discount code to save 15-30% because this thing isn’t cheap.

You can save between 15% and 30% on your Trade Ideas subscription using our promo code during the checkout. I’ve created a little Trade Ideas discount help guide that describes what code to use and how to ensure that the discount is correctly applied to your purchase.

Is Trade Ideas Worth It? (The Honest Answer)

This is the question every trader asks before spending $1,524-3,048 per year on a stock scanner. Here’s my take after six months of daily use:

Trade Ideas is worth it if:

- You’re an active trader making 3+ day trades per week

- Your trading income exceeds $2,000/month (the subscription pays for itself in opportunities found)

- You need real-time scanning across thousands of stocks simultaneously

- Time is money, you’d rather have AI find setups than manually screen all day

- You trade US stocks exclusively (Nasdaq, NYSE, OTC)

Trade Ideas isn’t worth it if:

- You’re a casual investor making a few trades per month

- You’re not yet profitable (focus on education first, then tools)

- You primarily trade international markets, crypto, or futures

- You’re satisfied with your broker’s built-in screener

- You need advanced charting more than scanning (get TradingView instead)

The cost-benefit is simple: if Trade Ideas finds you even one or two additional profitable trades per month, it’s paid for itself. For serious traders, the platform offers enough value through its real-time scanning, AI trading signals, and backtesting tools to justify the premium price.

About Trade Ideas: What You’re Actually Getting

Let’s cut through the marketing fluff: the Trade Ideas platform is a stock scanner on steroids, built specifically for finding day trading opportunities in US markets. It’s been around since 2003, which in fintech years makes it ancient, but they’ve continuously updated it with features that actually matter, most notably HOLLY AI, which launched in 2016.

The core product is a real-time scanner that monitors thousands of stocks simultaneously and alerts you when specific conditions are met. Think of it as having 50 different traders watching different parts of the market and yelling at you when something interesting happens, except it’s all software, happens in milliseconds, and won’t steal your lunch from the office fridge.

What makes Trade Ideas different from your broker’s built-in screener? Speed, customization depth, and AI integration. Your broker’s screener is like using a magnifying glass. Trade Ideas is like having a satellite surveillance system.

The Trade Ideas technology powers everything from basic gap scanners to complex multi-factor algorithms, and it’s backed by decades of market data analysis. Unlike many newer platforms, Trade Ideas has survived multiple market crashes and proven its value to professional traders in the finance industry.

Getting Started: First Day with Trade Ideas

When you first open the Trade Ideas platform, you’ll be greeted with what they call the default layout, a workspace with multiple windows showing different scanner results, charts, and the Channel Bar on the left side. Don’t panic if it looks overwhelming. That’s normal.

Here’s how I recommend new traders approach their first trading day with Trade Ideas:

- Start with the Channel Bar – This vertical menu on the left gives you access to pre-configured layouts for different trading styles. Click “Small Cap Movers” or “Gap Scanners” to see instant results.

- Join the live trading room – Seriously, do this on day one. The chat room is filled with active traders who share their setups in real-time. I learned more in one trading week watching the chat rooms than I did in a month of solo experimentation.

- Use paper trading first – Trade Ideas offers unlimited simulated trading. Test the platform’s AI trading signals and your own scanner configurations without risking real money. This is how you avoid expensive mistakes during your learning phase.

- Watch the “Getting Started” videos – Trade Ideas education resources include a comprehensive YouTube channel with tutorials. The videos from TI University cover everything from basic scanner setup to advanced strategies.

The trading experience improves dramatically once you understand the Channel Bar system. Instead of building everything from scratch, you can switch between pre-configured layouts for gap trading, momentum plays, or low float stocks with a single click.

The Stock Scanner: Why This Thing Actually Delivers

Over 500 Filters and Alert Types (No, Seriously)

The Trade Ideas scanner is where this platform absolutely shines. I’m talking about over 500 different filters and trade alert types. Want to find stocks gapping up by at least 10% with minimum pre-market volume of 100,000 shares? Done. Want to scan for Fibonacci retracements happening in real-time during market hours? Done. Want to find low float stocks making new 52-week highs with RSI divergence? Absolutely.

Here’s what I love about this: you don’t need to code anything. Most stock screeners make you write Python or C# scripts to create complex scans. Trade Ideas? You just click the filters you want, set your values, and let it run. It’s like Legos for traders, powerful building blocks that anyone can combine.

The Real-Time Speed Problem (That Trade Ideas Solves)

Every trading platform has “screeners,” but here’s the dirty secret: most of them are slow, refresh every few minutes, and miss the actual moves. As a day trader, if your scanner shows you an opportunity 5 minutes after it happened, you’re not trading, you’re bag-holding.

The Trade Ideas scanner runs real-time scans continuously. Not every 30 seconds. Not when you hit refresh. Continuously. This means you see opportunities as they’re developing, not after the move is already over and Twitter is posting about it.

You can run as many scans as you want simultaneously, 10, 20, 50 different scanners all watching different setups. I usually run about 8 different scans at the same time: gap-ups, high relative volume, new highs, bull flags, you name it. Your computer might hate you, but Trade Ideas handles it like a champ.

Pre-Configured Scanners (For When You’re Lazy Like Me)

Don’t want to build your own scans? Trade Ideas offers dozens of pre-configured scanners for common setups:

- Top gap-ups and gap-downs – Perfect for pre-market preparation

- Unusual volume movers – Catches momentum before the crowd

- New highs and new lows – Breakout and breakdown opportunities

- Low float stocks – Small float plays with explosive potential

- Opening range breakouts – Classic day trading setups

These alone are worth the subscription price if you’re starting out and don’t know what to look for yet.

The One Big Limitation Nobody Talks About

Here’s something you need to know before subscribing: Trade Ideas only covers US stocks. No European markets. No Asian markets. No crypto. If you’re trading anything outside of Nasdaq, NYSE, or OTC stocks, this platform is useless to you.

But here’s the silver lining: all US exchange market data fees are included in your subscription. While competitors like TradingView charge you extra for real-time data from each exchange, Trade Ideas bundles everything into one price. So you’re not getting nickel-and-dimed with $10/month here, $15/month there for data feeds.

The Charts: Good Enough, Not Great

Trade Ideas charts are… fine. They’re connected directly to your scanner results, which is super convenient, you can click through stocks in your scan and the charts update instantly. Time frames start at one minute (perfect for day trading), and you get all the basic indicators you’d expect: VWAP, volume, moving averages, RSI, etc.

You can annotate charts and draw trend lines, and prices are real-time. But let’s be real: if you’re coming from TradingView or TrendSpider, Trade Ideas charts will feel basic. They get the job done, but they’re not why you’re buying this platform.

My setup: I use Trade Ideas for scanning and identifying opportunities, then switch to TradingView for detailed technical analysis. Works perfectly. Many professional traders I know run multiple monitors, Trade Ideas on one screen for scanning, TradingView on another for charting, and their broker platform on a third for execution.

The AI Features: HOLLY Is Actually Legit

First-Gen AI: HOLLY (Been Around Since 2016)

Let’s talk about what everyone asks about: the AI. Trade Ideas launched HOLLY (their first-generation artificial intelligence system) back in 2016, way before ChatGPT made AI the buzzword of the decade. And here’s the thing, it actually works.

HOLLY AI automatically identifies trade entry and exit points based on probability analysis. It’s not magic, and it’s not going to make you rich overnight, but it genuinely found trade ideas I would have missed. The AI monitors thousands of stocks, identifies patterns that have historically worked, and gives you specific entry prices, stop losses, and profit targets.

What I really appreciate: HOLLY AI tracks every trade recommendation. So even if you log in late, you can review what HOLLY recommended earlier in the trading day, see what worked, what didn’t, and learn from it. This accountability is rare in trading software, most platforms want to show you only the winners.

The Three Versions of HOLLY AI

Trade Ideas Premium subscribers get access to three different HOLLY AI systems, each with distinct trading strategies and risk profiles:

- Holly Grail – Conservative approach, higher win rate, smaller gains

- Holly 2.0 – Balanced risk/reward with momentum focus

- Holly Neo – Aggressive plays, lower win rate, bigger potential gains

Each AI system analyzes new market data continuously and updates its strategies based on current market direction. The newest feature, called Money Machine, even has auto trading capability where it can execute trades automatically based on real-time performance metrics rather than just hitting predetermined price targets.

I haven’t used the full auto trading yet (still too much of a control freak), but the paper trading results are impressive. The Money Machine represents a legitimate AI trading platform that goes beyond simple scanning, it’s actual algorithmic execution.

TradeWaves: The Visual Buy/Sell Signal System

TradeWaves is Trade Ideas’ visual indicator system that overlays colored bands on your charts based on exponential moving averages (EMAs). Green means trending up, red means trending down. Sounds simple, and it is, but simple often works in trending markets.

I use TradeWaves as a confirmation tool rather than my primary signal. When HOLLY AI or my custom scans find a stock, I’ll check TradeWaves to see if the trend aligns. It’s particularly useful in choppy trading scenarios when you need that extra confirmation before pulling the trigger.

Education and Support: Better Than Expected

I’ll be honest, I didn’t expect much from the educational resources, but Trade Ideas education delivers. You get:

- Comprehensive written guides for every feature

- YouTube video tutorials (surprisingly well-produced)

- Live trading room sessions where experienced traders walk through setups

- Regular webinars covering platform features and strategies

- TI University courses for deeper strategy development

The live trading room alone is worth something. It’s not just promotional nonsense, real active traders share their scans, discuss setups in real-time, and answer questions in the chat room. I’ve picked up several scanner configurations just from watching what professional traders build during the trading week.

The community aspect is genuinely valuable. Whether you’re looking for short trade ideas, swing setups, or just want to see how serious traders navigate different trading styles, the chat rooms provide valuable information you won’t find elsewhere.

Direct Broker Integration: Trade From the Platform

One feature that surprised me: you can actually trade directly from Trade Ideas. Most scanners just find opportunities and then you manually enter trades in your broker platform. The Trade Ideas platform can connect to Interactive Brokers and E*TRADE through its Brokerage+ feature, letting you place orders right from the chart.

You can:

- Click buy/sell buttons directly on the chart

- Use a simple trading DOM (depth of market display)

- Let AI trade alerts automatically trigger orders in your brokerage account

- Execute trades automatically based on HOLLY AI signals

I still prefer to manually enter most day trades (trust issues with automation), but for traders who want a more streamlined active trading workflow, this integration is genuinely useful. The ability to execute trades automatically is a game-changer for traders who’ve backtested their strategies and trust the AI trading signals.

Paper Trading & Backtesting: Practice Before You Lose Money

The Simulator That Actually Works

Trade Ideas offers a complete paper trading simulator, which is huge because many platforms charge extra for this. You can test your trading strategies, follow AI alerts, and see how you’d perform, all with fake money and real market conditions.

This is perfect for:

- Testing new scanner configurations before risking real money

- Following HOLLY AI recommendations to see if they match your trading style

- Practicing with pre-market and after-hours opportunities

- Building confidence as a better trader before going live

I spent my first month with Trade Ideas purely in simulation mode, which saved me from several stupid mistakes I definitely would have made with real money. New traders especially should spend at least 2-3 weeks in paper trading mode before risking capital.

OddsMaker: The Backtesting Engine

Want to know if a strategy actually works before trading it? The OddsMaker backtesting module lets you test any scanner setup or trading strategy against historical market data with a single click.

You can:

- Test strategies across different time periods

- Optimize entry signals and sell signals for maximum performance

- See exactly how often your setup wins or loses

- Analyze which market conditions favor your trading strategies

- Compare different trading scenarios side by side

This level of backtesting used to require expensive specialized software. Having it built into the Trade Ideas platform is legitimately game-changing for strategy development. Professional traders spend hours in OddsMaker optimizing their approaches before deploying them with real capital.

What’s This Actually Going to Cost You?

Alright, let’s talk money. The Trade Ideas subscription isn’t cheap, but the pricing is at least straightforward (unlike some platforms I could name).

Basic Plan: $127/Month or $1,068/Year

The Basic plan includes:

- Real-time stock scanning with 500+ filters

- Multiple simultaneous scanners

- Live trading room access

- Charting tools with real-time data

- Paper trading simulator

- Pre-configured scanner templates

- Formula editor for custom scans

- All US market data feeds included (no extra data fees!)

- Access to the Channel Bar with curated layouts

- Multiple windows for multi-monitor setups

Who this is for: Day traders who primarily need scanning and alerting. If you’re comfortable developing your own trading strategies and don’t need AI hand-holding, Basic has everything you need.

Premium Plan: $254/Month or $2,136/Year

Trade Ideas Premium adds:

- 1st Gen AI (HOLLY AI) trading signals, all three versions

- 2nd Gen AI (Money Machine) with auto trading capability

- Full backtesting with OddsMaker

- Smart risk levels for position sizing

- Enhanced Channel Bar with advanced templates

- TradeWaves indicator

- Advanced broker integration through Brokerage+

- More customization options for the desktop platform

- Priority support from the Trade Ideas team

Who this is for: Traders who want AI assistance, need backtesting capability, or want the most advanced features. If you’re making $10,000+ per month from day trading, the Premium upgrade is a no-brainer.

Free Plan: Worth Checking Out

There’s a free version called the Par plan that gives you access to the web version with delayed data. It’s basically a demo to see if you like the interface before committing. Don’t expect to actually day trade with it, but it’s useful for kicking the tires.

The Hidden Costs (That Aren’t Really Hidden)

Unlike some platforms, Trade Ideas doesn’t hit you with surprise fees:

- ✅ All US market data included (this alone saves $40-60/month vs other platforms)

- ✅ No per-trade execution fees (those come from your broker)

- ✅ No limits on number of scans or alerts

- ❌ Add-ons cost extra (AVWAP and GoNoGo are $49/month each)

Pro tip: Use an annual subscription and my discount codes to save 15-28%. On Premium, that’s $320-600 in savings. On Basic, it’s $160-290 saved. The annual plan always provides better value than paying monthly.

The Add-Ons: Worth It or Skip It?

Trade Ideas Add-Ons

Trade Ideas offers two optional add-ons at $49/month each. Both require an active Basic or Premium subscription.

AVWAP (Anchored VWAP): For Volume Traders

AVWAP stands for Anchored Volume Weighted Average Price, based on Brian Shannon’s methodology. Trade Ideas automatically:

- Draws AVWAP Pinch setups

- Finds stocks pulling back to anchored VWAP levels

- Scans for AVWAP IPO setups in real-time

My take: If you actively trade VWAP strategies and it’s core to your trading style, this add-on is excellent. If you don’t, it’s $49/month you don’t need to spend. I use VWAP in my technical analysis, but I manually draw anchored levels rather than paying for automation.

GoNoGo Charts: Simplified Trend Visualization

GoNoGo overlays color-coded trend indicators on your charts: green for uptrends, red for downtrends, neutral for sideways chop. It’s designed to remove ambiguity about market direction.

My take: It’s pretty, and it works, but I don’t personally find it worth $49/month. TradeWaves (included in Trade Ideas Premium) does something similar. Unless you’re specifically a GoNoGo methodology trader, skip this one.

What I Genuinely Love About Trade Ideas

After months of daily active trading with this platform, here’s what keeps me subscribed:

The scanning speed is unmatched. I’ve tested FinViz, TradingView, Stock Rover, and broker platforms. Nothing comes close to Trade Ideas for real-time alerting. When a stock gaps up and starts moving, the Trade Ideas scanner tells me immediately, not 2 minutes later when the move is already over.

The customization depth is insane. If you can imagine a scan, you can probably build it. I have scanner setups for gap-and-go plays, VWAP reversals, breakouts from consolidation, unusual options activity, average volume spikes, and about 15 other specific setups. Each scanner watches the entire market simultaneously.

The HOLLY AI actually works. I was skeptical about AI trading signals initially (I’ve seen enough “AI” marketing bullshit to last a lifetime), but the trade recommendations are solid. It doesn’t win every time, nothing does, but the win rate is good enough that I pay attention when HOLLY flags something. The platform has genuinely found trade ideas I would have otherwise missed.

Real-time data is included. This is huge. Other stock screeners charge $10-15 per exchange per month for real-time data. Trade Ideas bundles everything into one price. If you’re comparing costs, factor in the market data fees you’re saving.

The community is helpful. The trading room isn’t just promotional fluff, real traders share real setups. I’ve learned new trading strategies just from watching what active traders build during the trading week in the chat rooms.

Paper trading is included. Being able to test strategies with zero risk before committing real capital is invaluable, especially when trying new scanner setups or following AI trading signals. New traders can spend months developing their trading experience in simulation mode.

The Channel Bar saves time. Instead of rebuilding your workspace every trading day, you can switch between pre-configured layouts instantly. Gap scanners in the morning, momentum scans midday, swing setups in the afternoon, all one click away.

What Could Be Done Better

Nothing’s perfect. Here’s what annoys me about Trade Ideas:

The price is steep. $127/month minimum is a lot, especially for newer traders. And Trade Ideas Premium at $254/month? That’s $3,000+ per year. You need to be making decent money from day trading for this to make financial sense.

The interface feels dated. The desktop platform works great functionally, but visually it looks like it was designed in 2010. It’s not ugly, just… not modern. The web version is slightly better but still behind platforms like TradingView in terms of visual polish.

The learning curve is steeper than expected. Trade Ideas markets itself as user-friendly, and compared to coding your own scanners it is. But there are so many features and options that new traders often feel overwhelmed. Expect to spend at least a week learning the platform before you’re comfortable. Trade Ideas education helps, but there’s still a lot to absorb.

Charts are basic. If you’re coming from TradingView or TrendSpider, Trade Ideas charts will disappoint you. They work fine for quick technical analysis alongside scanner results, but they’re not a replacement for dedicated charting software.

US stocks only. If you trade international markets, crypto, or futures, Trade Ideas won’t help you. It’s strictly US equities (Nasdaq, NYSE, OTC).

Mobile app is limited. There’s a mobile app, but it’s basically for checking alerts and viewing scanner results. You can’t build complex scans or use most advanced features on mobile. This is a desktop platform designed for professional traders with multiple monitors.

No refunds on annual subscriptions. If you pay for a full year and decide you hate it after 2 months, tough luck. This is why I recommend starting with monthly billing until you’re sure the trading experience fits your needs.

Who Should Actually Use Trade Ideas?

Trade Ideas is Perfect For:

- Active traders who make 3+ day trades per trading week

- Momentum traders looking for gap-ups, volume spikes, and breakout setups

- Pattern traders who want to scan for specific technical formations in real-time

- AI-curious traders who want algorithmic assistance without learning to code

- US stock traders who need comprehensive market coverage in one platform

- High-volume scanners who want to run dozens of different scans simultaneously

- Serious traders whose trading income justifies the Trade Ideas subscription cost

- Professional traders who value time and need the fastest real-time alerts

- Low float specialists who hunt for small cap and low float stocks with explosive potential

Skip Trade Ideas If:

- You trade casually (few times per month), the cost won’t justify the benefit

- You’re primarily a long-term investor, fundamental screening tools are better

- You trade international markets, Trade Ideas is US-only

- You’re just starting out, cheaper platforms exist for learning the basics

- You prefer fundamental analysis, Trade Ideas is built for technical traders

- You need advanced charting, TradingView or TrendSpider are better chart platforms

- You’re on a tight budget, $127/month is a lot when you’re not profitable yet

How Much Can a Day Trader Make with $1,000?

This is one of the most common questions I get, and it ties directly into whether Trade Ideas is worth the investment.

Here’s the brutal truth: most day traders lose money, especially in their first year. But with the right tools, proper risk management, and consistent strategy execution, a skilled day trader can potentially grow a $1,000 account.

Realistic expectations with $1,000:

- Conservative goal: 2-5% per month ($20-50/month)

- Aggressive goal: 10-20% per month ($100-200/month)

- Expert traders: Can occasionally achieve 30%+ monthly returns, but this isn’t sustainable long-term

The challenge with a $1,000 account is that you’re limited by the Pattern Day Trading (PDT) rule unless you’re only taking 3 day trades per trading week. This is where Trade Ideas can help, by finding the highest probability setups, you can make those 3 weekly trades count.

Here’s where Trade Ideas helps:

- HOLLY AI filters thousands of stocks to find the best daily opportunities

- Real-time scanning catches momentum moves before they’re over

- Backtesting lets you verify strategies before risking capital

- Paper trading allows practice without risking that $1,000

If you’re starting with $1,000, I’d honestly recommend spending your first 3-6 months paper trading with a free version or cheaper platform, learning the basics, and then upgrading to Trade Ideas once you’re consistently profitable in simulation. Don’t spend $127/month on tools when you’re working with a tiny account, invest in Trade Ideas education first, then the tools.

Is There Anything Better Than Trade Ideas?

The honest answer: for day trading US stocks with AI assistance, no, Trade Ideas is currently the best stock scanner available. But “better” depends on what you need.

Trade Ideas is the best at:

- Real-time scanning speed

- AI-generated trading signals (HOLLY AI, Money Machine)

- Number of filters and customization options

- Integrated backtesting and paper trading

- All-in-one solution for active traders

Other platforms are better at:

- TradingView: Advanced charting and technical analysis

- TrendSpider: Automated pattern recognition

- Stock Rover: Fundamental analysis and long-term research

- Benzinga Pro: News-driven trading and catalyst scanning

- Finviz: Simple screening at low cost

The “best” platform depends on your trading style. For pure day trading with emphasis on momentum, gaps, and technical setups, nothing matches what the Trade Ideas platform delivers. For other trading styles, there may be better options.

Many professional traders use Trade Ideas as their primary scanner but supplement it with other tools. The platform isn’t trying to be everything, it’s specifically optimized for finding and acting on short-term trading opportunities in US stocks.

My Final Verdict on This Trade Ideas Review

After months of daily use, I give Trade Ideas 4.2 out of 5 stars.

Here’s my honest assessment: Trade Ideas is the best real-time stock scanner available for day traders, period. The scanning speed is unmatched, the customization options are overwhelming in a good way, and the AI features actually deliver value. HOLLY AI isn’t magic, but it’s found me profitable setups I would have missed.

But, and this is important, the Trade Ideas platform is expensive specialized software for a specific type of trader. If you’re not day trading US stocks actively, you’re paying for features you won’t use. The basic charts won’t impress anyone coming from TradingView. The learning curve is real. And the cost only makes sense if your trading generates enough profit to justify it.

To save some money at the start, use my discount codes (PROP15, PROP25, PROP28, PROP30) to save 15-30% (15% works always, 25%-30% only during flash sales). Test it thoroughly in paper trading mode, spend time in the trading room learning from professional traders, and decide if this is the right scanner for your trading week. The platform is powerful, but only you can determine if that power is worth the price for your specific trading journey.

The Cost-Benefit Calculation is Simple:

- If you’re making $3,000+ per month from day trading → Trade Ideas will likely pay for itself in opportunities found and time saved

- If you’re making $500-1,000/month → Trade Ideas Basic might be worth it, Premium is probably overkill

- If you’re not profitable yet → Focus on cheaper educational resources first, come back to Trade Ideas when you have a proven strategy

My Recommendation:

- Start with the free version (Par plan) to see if the interface works for you

- Subscribe to Basic monthly (not annual) for 2-3 months to test properly

- Track specific trading opportunities Trade Ideas found that you wouldn’t have found otherwise

- Upgrade to Trade Ideas Premium only if you’re using AI trading signals regularly and need backtesting

- Use my discount codes because these subscriptions aren’t cheap

The platform has been around since 2003, which in tech years makes it ancient. They’ve survived multiple market crashes, countless competitor products, and continuous technological shifts. That longevity tells you something, Trade Ideas works, and traders keep paying for it year after year.

Is Trade Ideas perfect? No. Could the interface be more modern? Yes. Should the charts be better? Absolutely. But for real-time scanning of US stocks with the depth and speed day traders need, nothing else comes close to what Trade Ideas offers.

If you’re serious about day trading and ready to invest in professional tools, the Trade Ideas scanner delivers. Just make sure you’re actually the right type of trader for this platform before dropping $127-254 per month on it.

hidden – war google gemini extract

Trade Ideas is explicitly defined as more than a mere trading tool; it is an “EXPERIENCE that Transforms how you Profit in the Stock Market”. Positioned as the “Most Powerful Technology for Active Investors,” the platform is engineered to highlight stocks with the potential for large percent gains and identify momentum through new, improved visualization and sophisticated Artificial Intelligence (AI). This technology is built from the ground up, not only helping users find stocks to trade but also assisting in the management of those trades. Trade Ideas is Artificial Intelligence backed by highly skilled trading experts, representing the most powerful & innovative Market Intelligence software available.

Quick Summary

Trade Ideas is a highly flexible, AI-backed Market Intelligence software that excels in real-time scanning, momentum detection, and strategy validation. It features proprietary AI systems like Holly (1st Gen) for real-time trade signals and the forthcoming Money Machine (2nd Gen) for automated momentum trading. Key functions include the Streaming Alerts (“The Crown Jewel”), robust Backtesting (OddMaker), and risk-free Simulated Trading. While the technology offers unparalleled customization and data access (over 500 data points), it is subscription-based, requires Real-Time Data access for full utility, and is optimized primarily for Windows operating systems (Mac requires virtualization).

Pros and Cons of Trade Ideas

| Pros | Cons |

|---|---|

| Advanced Proprietary AI: Holly (1st Gen) gives precision buy/sell signals without setup. The upcoming Money Machine (2nd Gen) automates the top momentum trades. | Platform Compatibility: Trade Ideas Pro is designed for Windows; Mac users require virtualization solutions such as Parallels Desktop or AWS. |

| Unmatched Real-Time Data & Scanning: Streaming Alerts are the “Crown Jewel” and deliver instantaneous event notifications without requiring refresh. | Subscription Cost: Access to the most powerful features, like Holly and Backtesting, requires the TI Premium subscription ($178/month billed annually). |

| Robust Strategy Validation: OddMaker allows users to score trading plans and entry signals against historical data (backtesting) to “discover what truly works”. | Delayed Data on Free Tier: The Tester (Free Gateway) only provides access to delayed data. |

| Risk-Free Practice: Real-Time Simulated Trading (Paper Trading) builds confidence as you refine strategies using live data before risking real money. | High Risk Warning: The publisher explicitly states that Trading contains substantial risk and is not for every investor. |

| Superior Visualization: TradeWave provides clear, instant, actionable buy/sell tags directly on charts [21]. Stock Races offer visually engaging comparison of multiple stocks’ real-time performance. | 2nd Gen AI Access Cost: Future reserving access to Live Trading the Money Machine involves a substantial **$5K price increase** after the initial limited signups. |

| Brokerage Integration: Brokerage Plus supports one-click trading directly from charts and links to major partners like IBKR, CenterPoint Securities, and Cobra Trading. | Technical Complexity: The platform is highly flexible, utilizing **over 500 data points** (Alerts & Filters), which suggests a significant learning curve for full customization. |

Deep Dive Into Core Features

Artificial Intelligence and Signal Precision

The platform’s strength is anchored in its commitment to AI technology, designed to give the edge that makes the difference.

- Holly (1st Gen AI Signals): Holly is the Virtual Trading Assistant Intelligence. This system is designed to provide precision buy/sell signals including entry and exit points in real-time, crucially requiring no configuration from the user. Holly operates by analyzing millions of potential scenarios using a robo-advisor engine. The effectiveness is demonstrated by Market-Beating Signals such as AI Buy Signals for NFE (In 3 Days), QMCO (In 1 Week), and NTLA (In 2 Days).

- Money Machine (2nd Gen AI): This is called the “Biggest Innovation in Retail Trading History”. The Money Machine Advanced AI is designed to identify the market’s top 3 strongest momentum trades and automate the rest. Users select their desired momentum (Upside, Downside, or Both), and the system monitors and ranks stocks to ensure the portfolio holds the highest-momentum opportunities. The first 100 spots were already reserved, demonstrating overwhelming demand.

Visual Clarity and Adaptive AI (TradeWave)

For traders who struggle with chart complexity, Trade Ideas offers dedicated tools for clear visualization:

- Intelligent Market Pattern Recognition: TradeWave is an adaptive AI that utilizes intelligent market pattern recognition to deliver expertly-timed signals through intuitive visual cues.

- Actionable Signals: It provides instant, actionable buy and sell signals directly on your charts. It is a great tool for new traders to “kind of know when the recommended buy and sell moment occurs”.

- Real-Time Adaptation: TradeWave constantly analyzes market data, fine-tuning the EMA bands for each stock in real-time to ensure the signals are the most relevant. The blue color of the EMA cloud indicates bullishness, and orange indicates bearishness.

Real-Time Scanning and Data Density

The platform’s ability to locate emerging opportunities is central to its utility, relying on powerful, real-time data technology.

- Streaming Alerts (“The Crown Jewel”): This feature is described as the “Crown Jewel of Trade Ideas that nobody else has”. It functions as a fully customizable, real-time scanner that alerts the user the moment the event triggers, eliminating the need for constant refreshing.

- Data Density and Customization: The platform is highly flexible, enabling active traders to configure and customize according to their needs. The software utilizes over 500 different data points (Alerts & Filters), with over 200 available for customization in scans and top lists.

- Stock Races: This feature transforms Top List data, presenting a competitive and visually engaging comparison of multiple stocks’ performance in real-time. This helps users visualize how stocks are moving in real time. Races are built on an underlying Top List and can be customized based on time (more popular) or value goals.

Strategic Development and Risk Mitigation

Trade Ideas emphasizes confidence building through validation and practice before live execution.

- Backtesting with OddMaker: The OddMaker tool allows users to transform trading hunches into proven strategies by scoring how well scans, entry signals, and trading plans perform over recent history. This process helps users “discover what truly works” and provides confidence.

- Simulated Trading (Paper Trading): Real-time Simulated Trading is incorporated into the Brokerage Plus module. This is a risk-free strategy development tool that allows users to practice and refine strategies using live market data without using real money. Users can create new simulated accounts, which always come with 4x margin, and use full order management capabilities, including setting stop-loss and target orders.

Trading Execution and Accessibility

The platform integrates directly with brokerage services and offers a streamlined execution process.

- Brokerage Plus and One-Click Trading: The Brokerage Plus interface allows users to send live orders to participating brokers. Users can trade directly from the chart using one-click execution or via a traditional order entry panel. Partner brokers include Interactive Brokers (IBKR), CenterPoint Securities, and Cobra Trading.

- Platform Compatibility: Trade Ideas Pro is designed for Windows operating systems. Mac users can still access the software by utilizing virtualization solutions like Parallels Desktop or cloud-based services such as Amazon Web Services (AWS).

Subscription Tiers and Features

Trade Ideas is subscription software only, and the core features are distributed across three primary tiers:

| Plan Name | Cost (Annual Billing) | Data Status | Key Features Included |

|---|---|---|---|

| The Tester (Free Gateway) | Free | Delayed data | Stock Racing, PiP Charts, Predefined Alerts, Technical Indicators, Trading Tournaments |

| TI Basic (The Blue Bundle) | $89 /month ($1068 Annually) | Real-Time Data | 10 Charts on screen, Customizable Layouts, Real-Time Paper Trading, In-app Trading |

| TI Premium (The Powder Elite) | $178 /month ($2136 Annually) | Real-Time Data | **1st Gen AI Signals (Holly)**, **Backtesting**, Smart Risk Levels, Channel Bar, RBI/GBI Window |

Users can also customize their plans with add-ons like the AVWAP ADD-ON and GONOGO ADD-ON.

By utilizing its sophisticated AI, real-time data scanning (“The Crown Jewel”), and robust validation tools like OddMaker and Simulated Trading, Trade Ideas provides active investors with the “edge that makes the difference.”